The implementation of the DayProfit strategy is intended for trading binary options and involves the purchase of CallPut options from 5 minutes. The work in this case is based on reversals during the day, which serve as precursors to microtrends. The proposed strategy is an excellent tool for identifying zones characterized by maximum deviations, which allows you to make a profit when concluding most contracts of the type in question.

The implementation of the DayProfit strategy is intended for trading binary options and involves the purchase of CallPut options from 5 minutes. The work in this case is based on reversals during the day, which serve as precursors to microtrends. The proposed strategy is an excellent tool for identifying zones characterized by maximum deviations, which allows you to make a profit when concluding most contracts of the type in question.

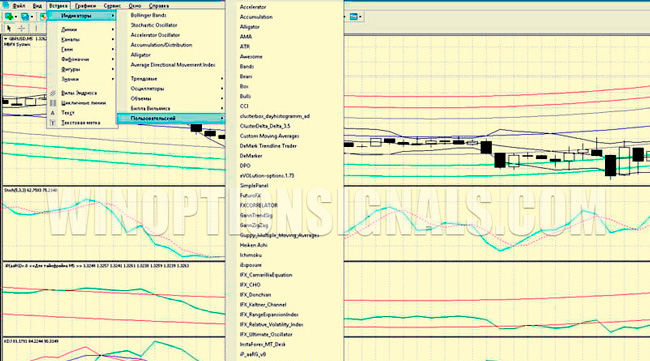

DayProfit is difficult to use in terms of determining entry points. The strategy works using oscillators, which are indicators for binary options (traditional, built into the MT4 terminal, as well as custom ones).

Strategy parameters for binary options DayProfit

The application of the strategy is related to the following points:

- Platform – MetaTrader 4 .

- Currencies – all available pairs, excluding crosses.

- Trading period (timeframe) – M5.

- Contract duration is 50-60 minutes.

- Temporary trading restrictions taking into account the sessions of Europe and America - from 10.00 to 22.00.

- Recommended brokers – Quotex , PocketOption , Binarium .

Description of the trading strategy

The exchange rate is an unstable value, changes occur constantly. In this case, there is a cyclical nature of such oscillations, characterized by a top and a bottom. Typically, a price reversal occurs when the “overbought” or “oversold” point is reached. Depending on the situation, some people stop buying and others stop selling, which leads to a correction in the exchange rate.

Zones characterized by overbought and oversold are identified through oscillators. They refer to indicators whose values vary according to a measurement scale from 0 to 1, and in some cases up to 100. Typically, several types of such indicators are used in order to reduce the likelihood of false signals. Such situations arise when there are strong trends, which forces one to resort to a fairly large number of instruments, rather than just one.

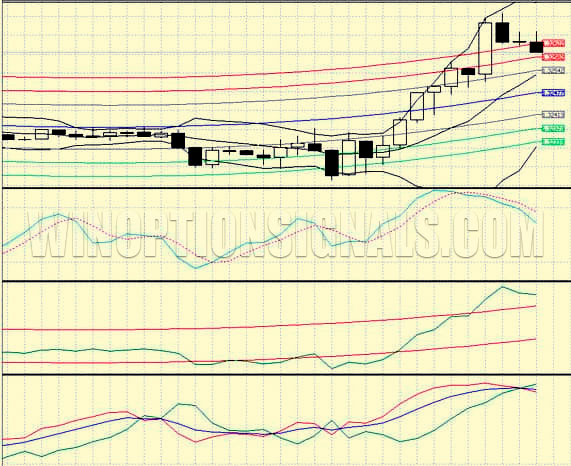

The DayProfit strategy is highly effective due to the use of accurate oscillators belonging to custom types. To eliminate erroneous signals, the MBFX System and Bollinger Bands are additionally used, where in the first case a trading system is understood, and in the second a special tool that draws lines.

DayProfit includes 5 indicators that determine specific parameters:

- Bollinger Bands – price fluctuations with a period of 10 using 3 moving averages.

- Stochastic – zones where overbought and oversold conditions occur.

- KDJ is a trend-type stochastic with preset parameters.

- Ip (aaRG) – scalping on 5-minute trading periods with initially set parameters.

- MBFX System is a channel trading system that has received international recognition.

The use of Ip (aaRG) is associated exclusively with time frames (TF) lasting 5 minutes without restrictions in terms of the choice of currencies.

Trading should be done in accordance with the trading hours of the stock exchanges. Optimal days - the appearance of news of a significant nature, which should correlate with entries in the economic calendar - at least two important events.

Rules for opening trades using the DayProfit strategy

Call option – 5 signals:

- The candle crosses the line of the Bollinger Bands indicator, and the candle closes below the line.

- The signal line of the Stochastic indicator is located below level 20.

- The asset price is below the middle line of the MBFX System indicator. The closing point of the candle is located below the lines formed by this indicator.

- The Ip indicator curve (aaRG) is below the established channel lines of this indicator.

- All three lines of the KDJ indicator come together, forming a node and giving a signal to enter a trade.

Put option – 5 signals:

- The candle crosses the line of the Bollinger Bands indicator, and the candle closes above the line.

- The signal line of the Stochastic indicator is located above the upper level.

- The asset price is above the middle line of the MBFX System indicator. The closing point of the candle is located above the lines formed by this indicator.

- The Ip indicator curve (aaRG) is above the established channel lines of this indicator.

- All three lines of the KDJ indicator come together, forming a node and giving a signal to enter a trade.

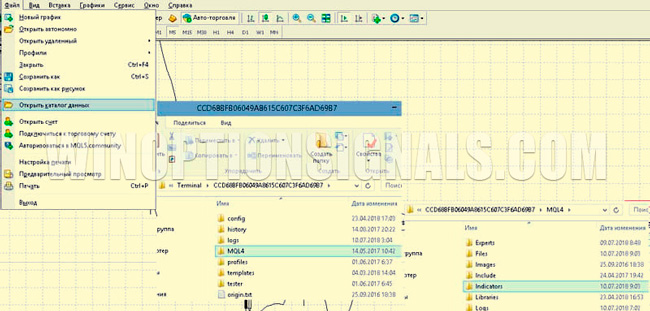

You can download all custom indicators for this strategy at the end of the article; they must be copied to the MT4 terminal folder called indicators, which is located in MQL. For this purpose, you can access the “Data Catalog” menu. After which you will need to restart MetaTrader 4.

In the process of graphically displaying indicators, we leave the settings the same. 3 indicators should appear in the window: in the quotes area - 2, and in the footer - 1. For your convenience, at the end of the article you can download a ready-made DayProfit strategy template.

Application of the DayProfit strategy in practice

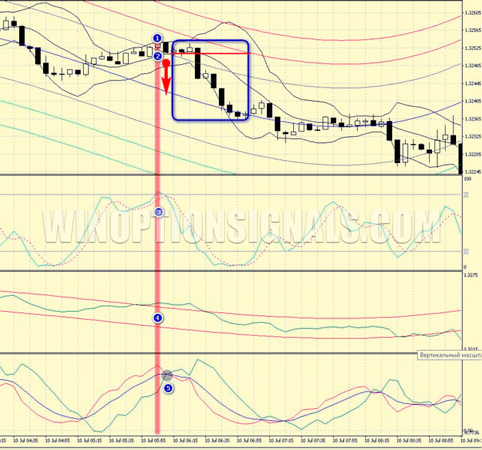

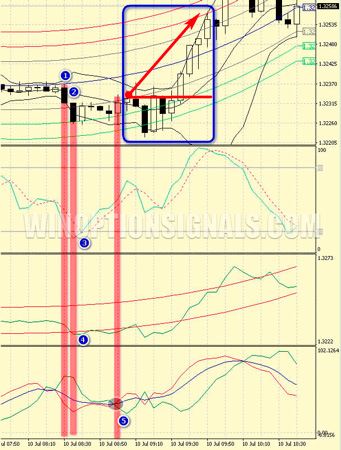

Consider the specific example shown in the figure below, within the framework of a Call option. The conditions are determined by the corresponding points on the graph:

- 1 – Bollinger crosses the candlestick at the bottom;

- 2 – the fact that another candle reaches MBFX is added to the mentioned signal;

- 3 – overbought is detected on stochastics and Ip (aaRG).

As for the transaction itself, it is carried out only when the 3 KDJ curves converge.

Expiration is determined by a time of 50 minutes, which assumes the formation of 10 candles during this period. The price breaks through the acquisition level of the Call option by a wide margin. As a result, the desired profit is generated.

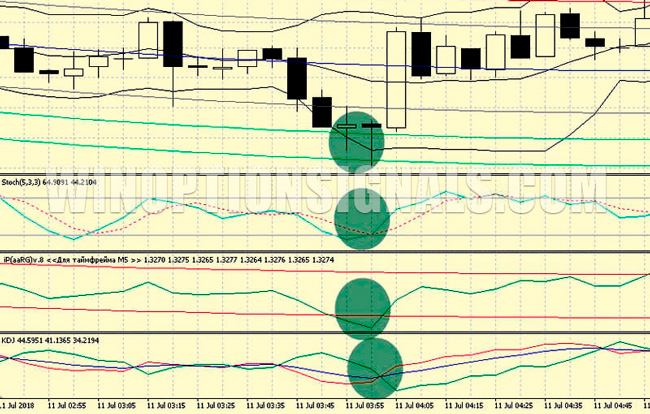

The following figure allows you to evaluate a Put option. Here, 4 signals appear on one candle. As you can see, the deal was concluded at the moment when the KDJ lines converged. An expiration of 50 minutes led to a result comparable to the above. The profit zone has been reached.

Money management within the DayProfit strategy

The effectiveness of trading using this strategy is achieved only if capital management is properly organized. The strategy under consideration is transactions concluded on a counter-trend movement, which means they are quite risky. There is a market axiom that states that the determination of market tops and bottoms cannot be 100% predictable. The filters used do not guarantee accurate trend characteristics in terms of turning points. Not all options are profitable. However, in practice, this strategy can provide about 65-70% of profitable transactions.

You should consider possible losses when you choose your starting bet for this strategy. To improve your performance, you can turn to the Martingale tactics, and for ease of calculation, you can also use the online calculator of the Martingale system . If the price moves up or down from the buy level of the option, then the newly opened positions must correspond to the same type of option (call or put) that was opened before.

Conclusion

DayProfit is a trading system that is optimal for use in the case of binary options for intraday trading. This is due to the fact that there is no reference to the trend and it is possible to predict the cyclical movement of quotes over a given period of time. The completion of a directional movement is signaled by the KDJ indicator, which increases the probability of determining the moment when the price begins to reverse.

The disadvantage of the DayProfit strategy is associated with the difficulty of tracking such a number of indicators. It takes experience to eliminate excessive errors. We recommend testing all new strategies on a demo account .

Download DayProfit strategy template

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionSignals , where we will definitely answer all your questions in the video.

See also:

Best binary options brokers (rating)

To leave a comment, you must register or log in to your account.