In binary options it is very difficult to create a trading strategy that brings regular profits. The matter is further complicated by the fact that the developed system must show equally profitable results regardless of market conditions. There are no strategies that will allow you to open exclusively profitable trades, since it is impossible to clearly predict the development of events in the market. Therefore, the right decision would be to create your own portfolio of trading strategies.

Let's imagine a situation in which your binary options trading system produces 60% profitable trades. Naturally, such indicators are not an impressive achievement. Beginners in the field of binary options trading believe that there is some kind of “Grail” and are trying to find it. In their opinion, such a trading system should be absolutely break-even or provide at least 90% of profitable trades.

Increasing the number of positive transactions from 60% to at least 70% seems to be an incredibly difficult task that requires incredible effort. In other words, any strategy has its own limit of profitability, which cannot be overcome due to a decrease in profitability due to the lack of reserve potential, which is the basis of the strategy. All subsequent improvements will require more effort.

Drawing up a portfolio of strategies allows you to get out of this situation. This is what we will talk about next.

Benefits of using risk diversification

It is much easier not to try to improve the existing strategy, but to start using several more along with it in order to compensate for losses. Most traders have heard the story of putting your eggs in more than one basket. In this case, the role of baskets is played by strategies for trading various instruments. In other words, we have a set of strategies based on several types of analysis. This analysis includes technical analysis and all its subtypes, as well as fundamental analysis .

It is much easier not to try to improve the existing strategy, but to start using several more along with it in order to compensate for losses. Most traders have heard the story of putting your eggs in more than one basket. In this case, the role of baskets is played by strategies for trading various instruments. In other words, we have a set of strategies based on several types of analysis. This analysis includes technical analysis and all its subtypes, as well as fundamental analysis .

The main task of forming a diversified portfolio is to select strategies such that the correlation between them is minimal or completely absent. It is also worth paying attention to the share of investment in each individual strategy. It must be directly proportional to the expected risks. This is the only way to achieve the maximum effect from using diversification.

Even after careful development and testing, the system has a number of vulnerabilities in market conditions. No strategy will be profitable 100% of the time. Sometimes there will be losing trades. The most undesirable scenario is a series of several losses, which will lead to a serious drawdown of the deposit. However, determining the profitability of a single strategy is much easier than determining the profitability of a diversified portfolio.

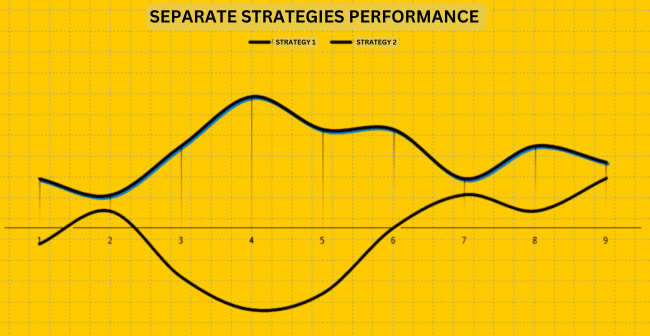

Let's imagine that we have two strategies at our disposal. For one of them, we observe a significant drawdown, and the second showed positive dynamics only in the first half of the testing period. In both cases we see an unstable result.

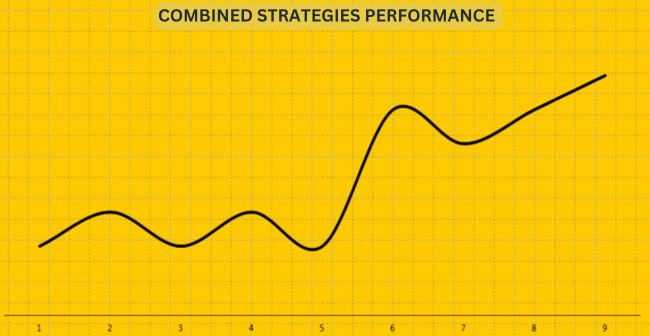

We can gain an advantage over the market by using several radically different approaches. It is very important that they have little correlation. In the example under consideration, the profit from the second strategy covers the losses from the first. All we have to do is add up the profits from both strategies. As a result, we will see that the profitability graph is quite stable and does not have significant drawdowns.

But we should not forget about the less successful scenario. We are talking about a situation in which all strategies of a diversified portfolio show unprofitable trading over the same time period. If the portfolio is selected correctly, then even if losses are summed up, the result will be less risk than in the case of trading only one of these strategies.

A certain amount of funds from the total deposit should be allocated for each strategy. The higher the effectiveness of a particular strategy, the higher the priority it has. Therefore, you should invest the smallest share of funds in the strategy with the largest number of losing trades, and as much as possible in the most profitable one.

Types of diversified portfolios

- A portfolio that includes several different strategies.

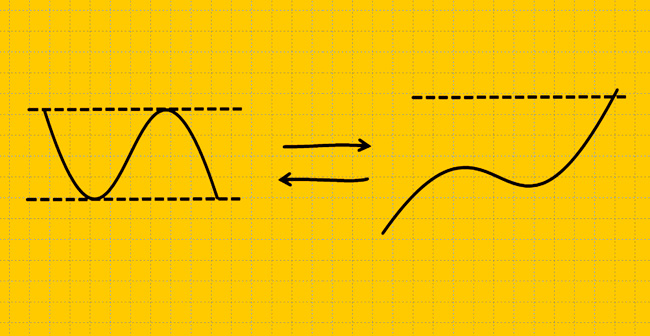

The most correct solution is to use strategies that differ in their operating principles. As you know, a strategy developed for trading during a flat does not show very good results if there is a stable trend in the market, and a trend strategy will turn out to be unprofitable during a flat.

Therefore, you can use completely different strategies that are in no way related to each other in meaning. For example, these could be strategies based on:

- Indicators for binary options ;

- Trend or flat;

- Graphical analysis ;

- Candlestick analysis ;

- Price Action .

- Volatility of currency pairs ;

- Scalping .

Thus, we can trade profitably regardless of market conditions. Today there are a huge number of mutually exclusive models. For example, you can achieve a good result by combining a strategy that generates income during corrective movements and a strategy that works on reversals. In other words, we simultaneously use several approaches that interpret the market situation differently relative to each other.

- A portfolio consisting of several time frames and instruments.

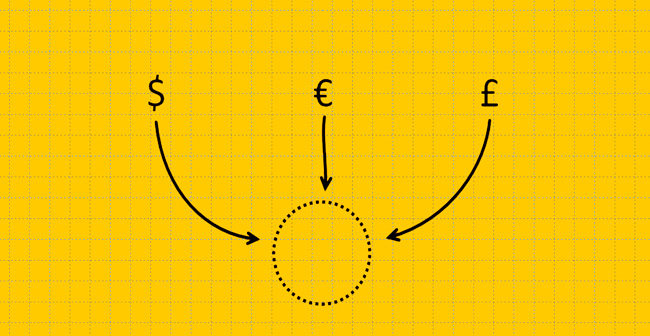

In this case we use several tools. This example is nothing more than classic diversification. We use an expanded arsenal of tools to work in one or several markets at once. You can combine absolutely any trading assets, which may include currency pairs , stocks, commodities and even cryptocurrencies . Each individual element behaves differently, and the price is formed as a result of completely different and unrelated factors. By using instruments from different markets, maximum efficiency can be achieved.

In the process of choosing a specific tool, it is necessary to take into account its characteristics depending on the season. It is best to create a portfolio of weakly correlated instruments . Seasonal patterns of currency pairs can be viewed on specialized Internet resources.

In addition, different fractal levels have their own patterns. Simply put, one specific strategy can show completely different results on different timeframes. This feature can be used to make a profit. The trader needs to determine the timeframe on which the strategy showed the best results, and trade on it. To do this, you need to conduct backtesting and additionally on a demo account .

- Combining multiple strategies into a single entity .

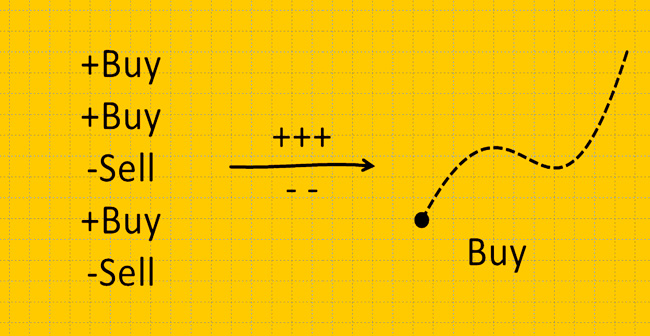

This approach is based on the principles of weighted signal tactics. Today there are a huge number of strategies that are similar to each other. There is no point in combining such strategies, since as a result we will simply complicate our work. It is better to combine strategies that use different approaches in the bidding process. Using this approach, a trader receives several signals from various sources and makes a trading decision based on them.

The main thing is not to overdo it, since excessive complication can make the portfolio unprofitable. You need to clearly understand the operating principle of the filters used and the level of their compatibility with each other.

Conclusion

By creating a portfolio of strategies, you can significantly increase the efficiency of the working system. It takes a lot of effort to improve one trading strategy. It is much easier to add several more to the one used and form one entity from them. Thus, several strategies will compensate for each other's shortcomings. And if you do not forget about the rules of money management and risk management , then you will not see a significant drawdown and will be able to achieve the optimal profitability/risk ratio.

See also:

How to choose a strategy for trading binary options

Top 5 Binary Options Trader Mistakes

To leave a comment, you must register or log in to your account.