On the largest P2P exchange LocalBitcoins, the trading volume doubled over the past year, 2023. People are also increasingly willing to exchange cryptocurrency for regular money: the trading volume in this direction has grown by 68%. On another platform, Paxful, the number of users has tripled in two years. All this is happening not only because of the growing popularity of cryptocurrencies, but also because people are actively interested in the possibilities of avoiding the participation of intermediaries: exchanges and exchangers.

|

The game for traders WinOptionGame is based on this very principle: fair competition, bets on the rise or fall of the Bitcoin rate without intermediaries. |

Read on in our review to find out how to profitably exchange cryptocurrency.

Content:

- Cryptocurrency vs. Fiat Money: What's the Difference?

- The Most Popular Cryptocurrency Exchange Methods for Beginners

- How to Exchange Cryptocurrency Using an Exchange

- P2P platforms: choosing the best options

- Selecting the ideal crypto exchanger .

- The best way to exchange cryptocurrencies: what is it?

- Conclusion

Cryptocurrency vs. Fiat Money: What's the Difference?

Cryptocurrency vs. Fiat Money: What's the Difference?

Almost everyone has heard of the largest cryptocurrencies – Bitcoin , Ethereum and Litecoin . And yet there is still a misunderstanding about how they differ from the usual dollars or yen. No problem, we will figure it out.

The type of money we are familiar with is called fiat. The word "fiat" is Latin for "order," "decree," or "will." All money, paper or digital, in the form of bank account entries—anything that is controlled by the state and not tied to the value of a real, usable asset like gold or silver—has come to be called fiat money. We, as a society, have come to recognize it as valuable, and that's why it's that way.

On the other hand, cryptocurrencies are digital money that are based on blockchain technology .

To make it easier to understand the main differences between cryptocurrency and fiat money, we have compiled their main characteristics in a table.

|

Characteristic |

Fiat money |

Cryptocurrency |

|

Issuer |

Central Bank |

Decentralized network |

|

Security |

Trust in the issuer, the country's economy |

Cryptography |

|

Control |

Centralized |

Decentralized |

|

Anonymity |

Low |

High (when using anonymous wallets) |

|

Safety |

Protection by the state |

Cryptography |

|

Transparency |

Limited |

Full (all transactions are public) |

|

Volatility |

Relatively stable |

They can change dramatically |

|

Regulation |

Regulated by central banks |

Poorly regulated |

|

Availability |

Widely distributed |

Limited availability |

|

Usage |

Everyday calculations, tax payments |

Investments, money transfers, payment for goods and services |

|

Examples |

Hryvnia, dollars, euros |

Bitcoin, Ethereum, Litecoin |

|

Speed of international transfers |

Days |

Minutes |

|

Cost of international transfers |

High |

Low |

Which one of these two options you choose will largely depend on your specific goals and needs. For example, if you need a currency for everyday transactions, then fiat money will likely be a more convenient option. However, if you are looking for an anonymous and decentralized currency that is not controlled by anyone, then cryptocurrency may be an interesting alternative for you.

The Most Popular Cryptocurrency Exchange Methods for Beginners

If you have recently become a happy owner of a cryptocurrency sum, then you have probably already thought about how to easily and simply exchange it for regular money. In this review, we will go over the three most popular ways to exchange crypto for beginners, each of which has its pros and cons. They are simple - you only need the cryptocurrency itself and a registration on one of the exchange platforms:

- Cryptocurrency exchange

- P2P platform

- Crypto exchanger

How to Exchange Cryptocurrency Using an Exchange

Important: Before using any crypto exchange, please read its terms and conditions.

Cryptocurrency exchanges are online platforms where you can buy, sell, and exchange cryptocurrencies for other digital assets or fiat money (such as dollars, euros, or sterling pounds). Their hallmark is high liquidity, which means that large trading platforms such as Binance , OKX, and Coinbase always have a large supply and demand of various crypto assets, allowing you to complete your trades very quickly.

Cryptocurrency exchanges are online platforms where you can buy, sell, and exchange cryptocurrencies for other digital assets or fiat money (such as dollars, euros, or sterling pounds). Their hallmark is high liquidity, which means that large trading platforms such as Binance , OKX, and Coinbase always have a large supply and demand of various crypto assets, allowing you to complete your trades very quickly.

Another advantage of using exchanges to exchange cryptocurrencies for fiat money is reliable measures to protect users' funds. For example, the world's largest exchanges Binance, OKX and Coinbase store most of their users' funds in offline wallets that are not connected to the Internet, which makes them less vulnerable to hacker attacks. And only a small part of the funds is stored in online wallets to ensure uninterrupted trading operations.

Pros and Cons of Popular Trading Platforms

Note: OCO order is an application on a crypto exchange that allows you to simultaneously set a limit order to buy and a stop order to sell, with one automatically canceled when the other is executed.

All of the three platforms – Binance, OKX, and Coinbase – offer convenient quick exchange features. They allow you to exchange cryptocurrency for fiat money safely and profitably without using complex orders such as OCO orders. Thanks to these features, users can quickly complete exchange transactions.

However, despite certain similarities, these trading platforms have different capabilities. For example, Coinbase does not support the very useful function of converting cryptocurrency to fiat without creating orders, as well as p2p trading for direct exchange between users without intermediaries.

In addition, these platforms also differ in the total number of fiat currencies they support. For example, Binance supports over 50 national currencies, OKX – 30, and Coinbase – only 20, including such rare examples as the Honduran lempira (HNL) and the UAE dirham (AED).

The main features of these trading platforms are listed in the table:

|

Stock Exchange |

Pros |

Cons |

|

|

Binance |

Huge selection of cryptocurrencies (over 600), low fees, high liquidity, easy-to-use platform, many useful features, support of P2P trading, active community. |

Regulated in North America only: Canada, US (limited regulation) Europe: France, Gibraltar, Italy, Lithuania, Cyprus, Spain Asia: Bahrain, Dubai (UAE), Kazakhstan, Japan, limited fiat support, hack history: May 7, 2019, October 15, 2020, October 6, 2021 |

|

|

OKX |

Low fees, high liquidity, easy to use platform, support of margin trading, futures and options, active community. |

Does not have a full license to operate in any jurisdiction. Operates under the legal framework of the following jurisdictions: North America: Canada South America: Argentina, Chile Europe: Gibraltar, Italy Asia: Dubai (UAE), limited fiat support, not available in the US |

|

|

Coinbase |

Regulated in the US and other countries, high security, easy to use platform, user training, suitable for beginners. |

Limited choice of cryptocurrencies (less than 250), high fees, low liquidity, limited trading features, not available in many countries. |

Binance offers some of the lowest fees on the market, ranging from 0.01% to 0.1%. OKX also offers low fees, ranging from 0.01% to 0.15%. While Coinbase has slightly higher fees, ranging from 0.5% to 1.5%.

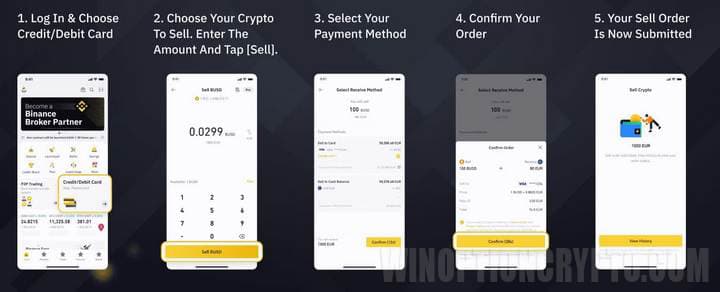

Binance Exchange Exchange: A Simple Step-by-Step Plan

Let's look at a simple step-by-step plan for exchanging cryptocurrency for fiat using the Binance exchange as an example.

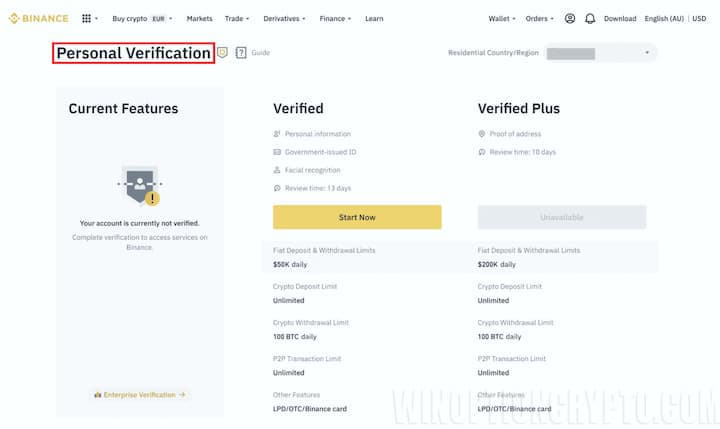

Step 1: Log in to your Binance account and complete KYC verification. After that, go to the Credit/Debit Card section, which is accessible from the main page of the app. If you are using the web version, select Credit/Debit Card from the Buy Crypto menu at the top of the main page.

Step 2: Select the cryptocurrency to sell, then specify the amount and fiat currency to exchange.

Step 3. Select a previously added credit or debit card to receive funds, or add a new one. Click "Confirm". Please note that only VISA cards are supported.

Step 4. Check the payment details and confirm the transaction within one minute. Otherwise, the price and amount of cryptocurrency received may change. To check the current market price, click "Refresh".

Step 5: Once you confirm, the transaction will be completed and you will receive a notification that it has been processed.

P2P Platforms: Choosing the Best Options

P2P (peer-to-peer) platforms are direct exchanges where users can directly buy and sell cryptocurrency from each other, without going through intermediaries. Such platforms can also act as guarantors of transactions, temporarily locking funds during the transaction. Although Binance is deservedly considered one of the leading P2P exchange platforms, like any other, it has its drawbacks that are important to be aware of.

For example, not all cryptocurrencies on the Binance P2P platform have sufficient trading volume and favorable exchange rates. This means that it may take longer to find a seller or buyer on this platform compared to others. While this is most likely to be the case with lesser-known coins and exotic fiat currencies like the Honduran lempira, it is still important to consider. It may also be that unique payment methods, such as Amazon gift cards or withdrawals to a bank card of a bank under US sanctions (e.g. VTB, Alfa Bank, etc.), may not be available.

In any case, it is worth paying attention to alternative P2P platforms. Perhaps, it is there that you will find new options that may be more interesting than those presented on Binance in some respects.

Pros and Cons of Decentralized Exchange

Before we start talking about the advantages and disadvantages of specific p2p platforms, it is worth understanding the pros and cons of this method of exchanging cryptocurrencies for fiat money.

Trading directly without intermediaries is beneficial for a number of reasons:

- Typically, P2P platforms do not charge transaction fees, or their fees are lower than those of centralized exchanges.

- As a rule, P2P platforms do not require KYC (Know Your Customer) verification, which means there is no need to provide your personal data.

- You determine the purchase and sale price of cryptocurrency yourself. While on the exchange, the purchase and sale price depends on the liquidity of the market (the volume of available orders), the type of order and the speed of its execution. For example, the type of order greatly affects the execution price: market orders are executed at the best available price, limit orders - at the specified or more favorable price, and stop orders - when the asset reaches a certain level.

Cons:

- Using a P2P exchange can be more complicated than working with centralized exchanges.

- Low liquidity can make it difficult to find a buyer or seller for some cryptocurrencies.

- There is a risk of fraud, so it is important to be careful when choosing a particular p2p platform.

- P2P platforms typically offer limited customer support compared to centralized exchanges.

Bored with Binance? Here are the 6 Best P2P Platforms for Safe and Profitable Exchange

Note: "Maker trading" means placing orders on P2P platforms to buy or sell cryptocurrency at a certain price, acting as a liquidity provider for other users.

Despite all the advantages and popularity of Binance, you should not conduct all your transactions only on this platform. If for some reason this centralized exchange stops working (for example, due to hacking or blocking of the account), it is important to have backup options. Here are some of the most popular ones:

- A great alternative to Binance is the Huobi platform. This popular exchange from the Seychelles is in great demand in the CIS countries. There are no fees for p2p exchanges on the exchange, and funds are not blocked for those who buy cryptocurrency as a "maker". In addition, you can withdraw funds to cards of banks that have fallen under US sanctions, such as Sberbank, VTB, Alfa-Bank and others.

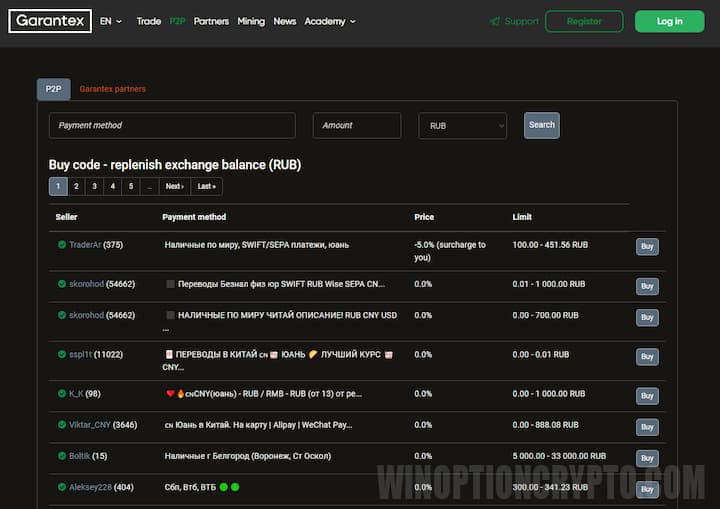

- Another platform aimed at clients from the CIS countries is Garantex. This platform is not at all like Binance and it will take some time to get used to its interface. Account replenishment occurs in a very peculiar way - by purchasing a special ruble code. It can be purchased in the p2p exchange section on the platform itself or for cash in large cities of the Russian Federation, such as Moscow, St. Petersburg and others.

The main advantage of this platform is the USDT to ruble rate, which is usually significantly higher than on Binance. Therefore, if you can top up your balance with cash, this will be a great alternative to the Cayman Islands platform. However, be careful with the cryptocurrency obtained on this exchange. Before using it, it is advisable to use mixers - services that "mix" funds from different users to hide the transaction history and make it difficult to track the origin of the cryptocurrency.

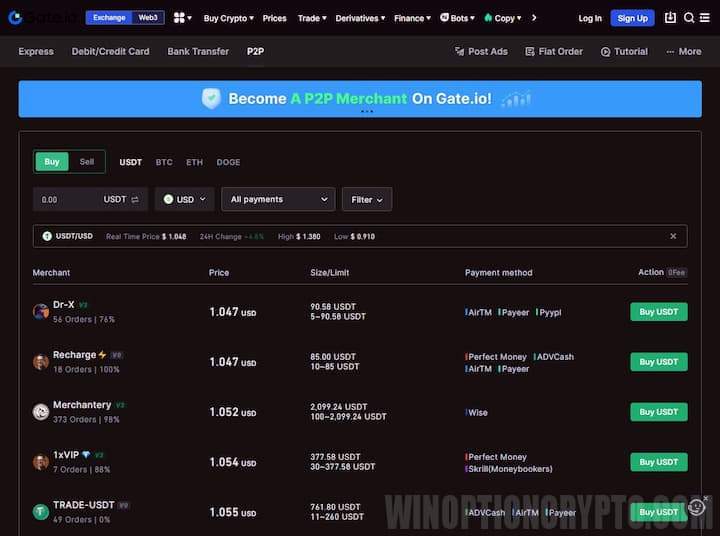

- Another interesting platform is Gate.io. Although its liquidity is lower than other platforms, this is compensated by the absence of a fee for p2p exchange and the ability to conduct large over-the-counter (OTC) transactions.

To attract users, the platform often holds raffles for valuable prizes, such as a MacBook Pro. Meme coins are also available for trading.

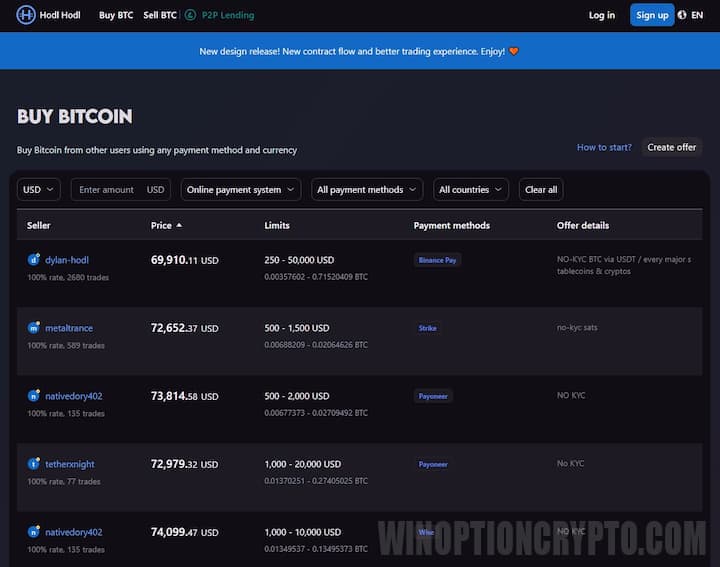

- Hodl Hodl differs from previous platforms in its anonymity and security. Hodl Hod is a non-custodial P2P platform, where users retain full control over their private keys and cryptocurrency. Transactions take place directly between them, without the participation of intermediaries. HodlHodl does not require KYC (identity verification) or AML (verification of the legitimacy of the origin of funds). All you need is to provide an email address and password to create an account.

The disadvantages include a fixed commission of 0.6% for each transaction, which is divided equally between the buyer and seller, as well as the limited number of cryptocurrencies offered. At the moment, the platform only allows transactions with Bitcoin (BTC), but in the future, it is planned to add support for other coins.

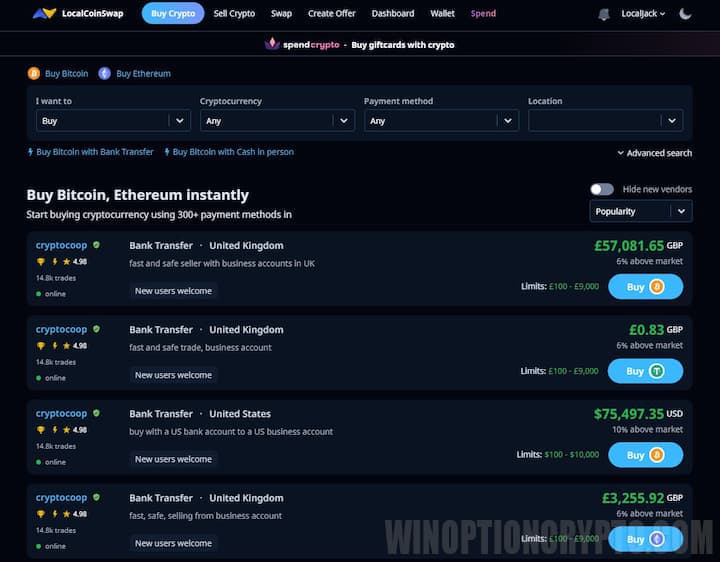

- Another interesting non-custodial platform is LocalCoinSwap. It has a very user-friendly interface and all the main cryptocurrencies for trading: BTC, Ethereum , Tether and others.

You can trade through this service using your crypto wallet . Among the disadvantages, we note low liquidity and a high commission of 1% of the transaction. We recommend considering this platform as an alternative to Hodl Hodl.

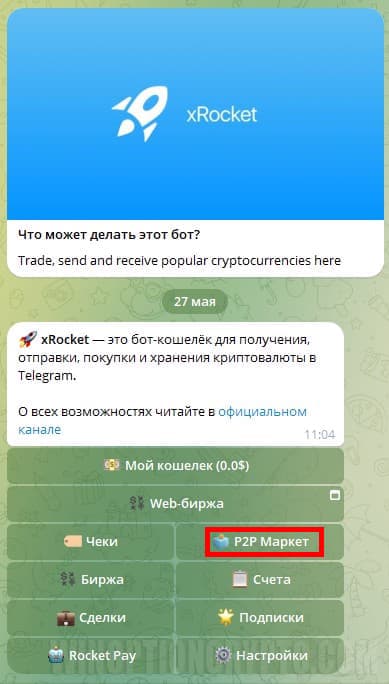

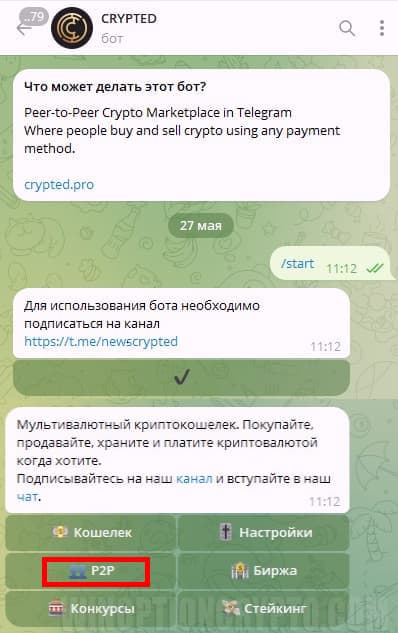

- If you don’t want to waste your time registering on the platforms described above, but want to simply, but at the same time safely and profitably exchange your cryptocurrency for fiat money, we recommend that you take a closer look at these telegram bots: @tonRocketBot and @Cryptedrobot

xRocket is a bot wallet for receiving, sending, buying and storing cryptocurrency in Telegram. With its help, you can safely make transactions by creating ads or responding to ads from other users. The bot acts as a guarantor, blocking the cryptocurrency for the duration of the transaction. The commission for purchase is 0%, for sale - 1%.

CRYPTED is a peer-to-peer cryptocurrency platform on Telegram where people buy and sell cryptocurrency using different payment methods. This bot also acts as a guarantor and holds coins for the duration of the transaction. Commission for purchase is 0%, for sale - 1%.

Five Steps to Choosing the Perfect P2P Platform

To choose the right platform, we recommend that you carefully study all available options and follow these five steps to make the right decision:

Step 1: Make sure the platform secures your assets. Check for two-factor authentication (2FA) and data encryption. Also, ask if there have been any security issues in the past.

Step 2. Choose a platform with high liquidity for trading the cryptocurrencies you plan to use. This will allow you to quickly find buyers or sellers. Check the trading volume on the platform for the coins you are interested in.

Step 3: Compare fees between different P2P platforms, paying attention to trading, withdrawal, and deposit fees. Choose the platform with the lowest fees to minimize your expenses.

Step 4: Make sure the platform offers you convenient payment methods. Some may accept fiat currencies such as USD, EUR, and GBP, while others are limited to cryptocurrencies only.

Step 5: Choose a platform with a reliable reputation. Read user reviews and learn about its security. Make sure that the platform you choose complies with the rules of the regulatory authorities.

In addition to these five steps, we recommend that you study the platform’s interface, check for a mobile app or additional services such as an escrow service, and compare your chosen P2P platform with centralized exchanges to determine the best option. Ultimately, choosing a P2P platform is a personal decision.

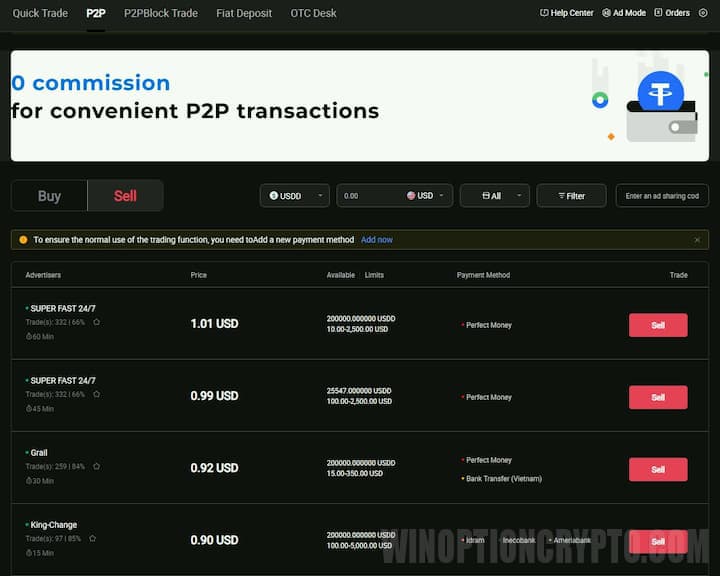

Easy Exchange on P2P Platform: Step-by-Step Instructions

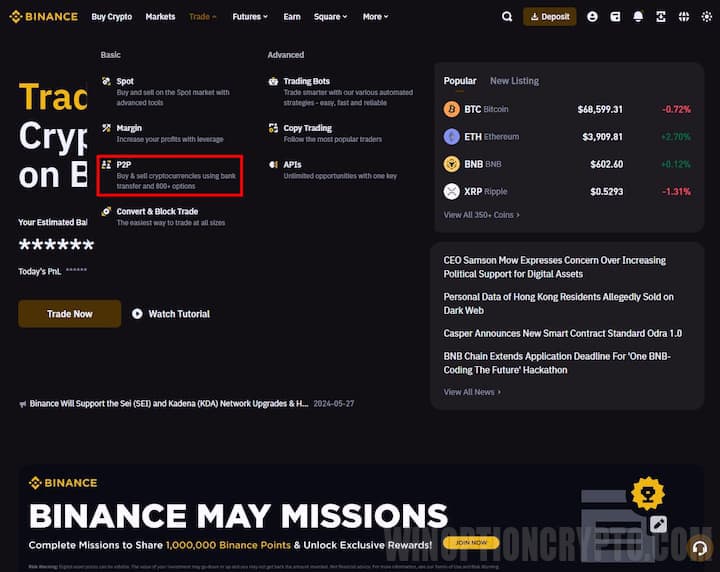

As an example, let's consider the exchange of cryptocurrency on the p2p platform of the Binance exchange.

Step 1: Before you start trading, make sure to enable SMS authentication and one of the two-factor authentication options: Binance/Google Authenticator, security key, or email. You can set this up in the Security section of the trading platform.

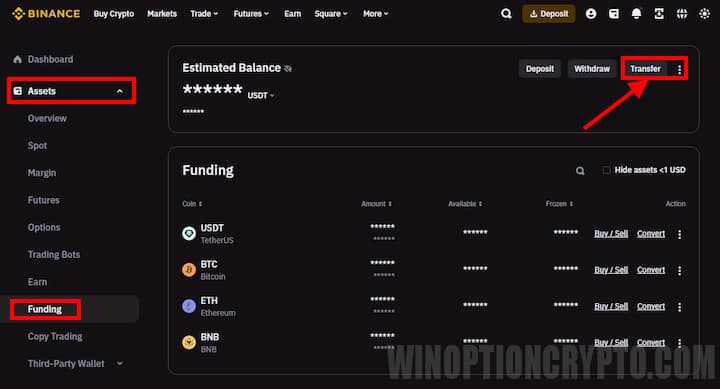

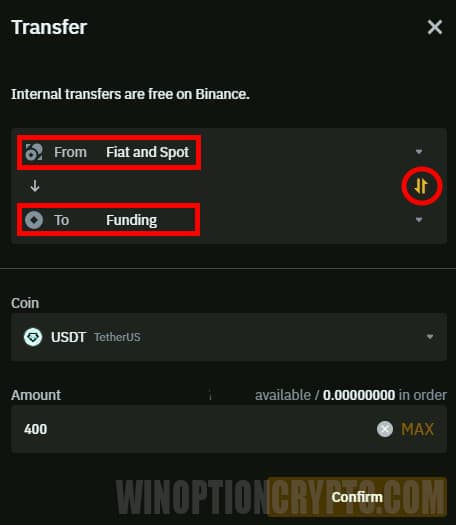

In addition, you should make sure that the cryptocurrency you are going to exchange for fiat money is on the balance of your p2p wallet. To do this, go to “Assets - Replenishment”.

Click the "Transfer" button, specify the amount you want to transfer from the main account to the p2p wallet, and confirm.

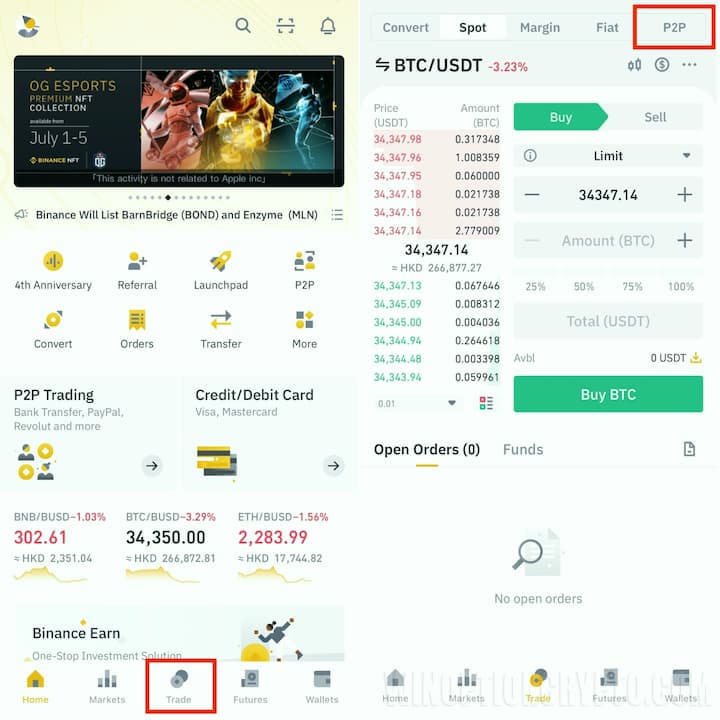

Step 2: Next, you need to select your preferred payment methods. This can be done in the Binance app: Trade > P2P

Step 3. Go to “Profile” and select “Payment Method”.

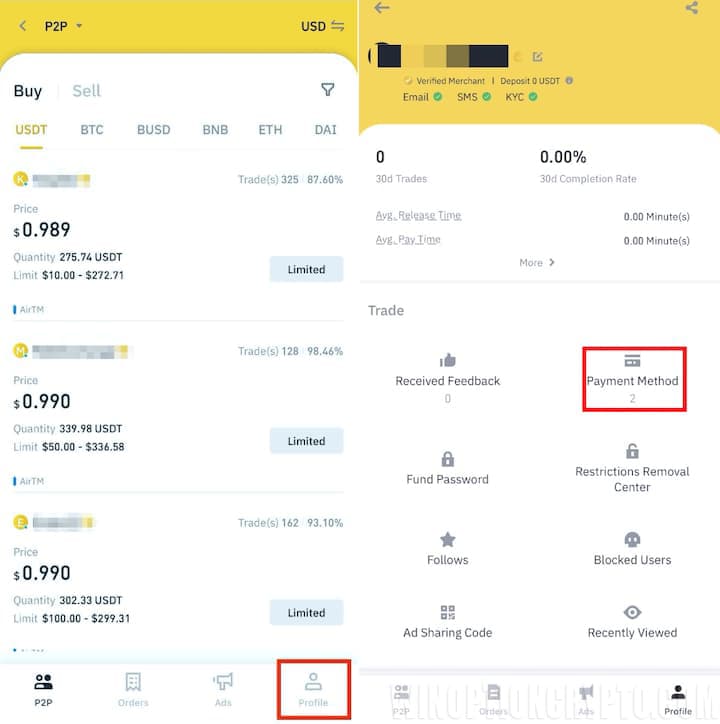

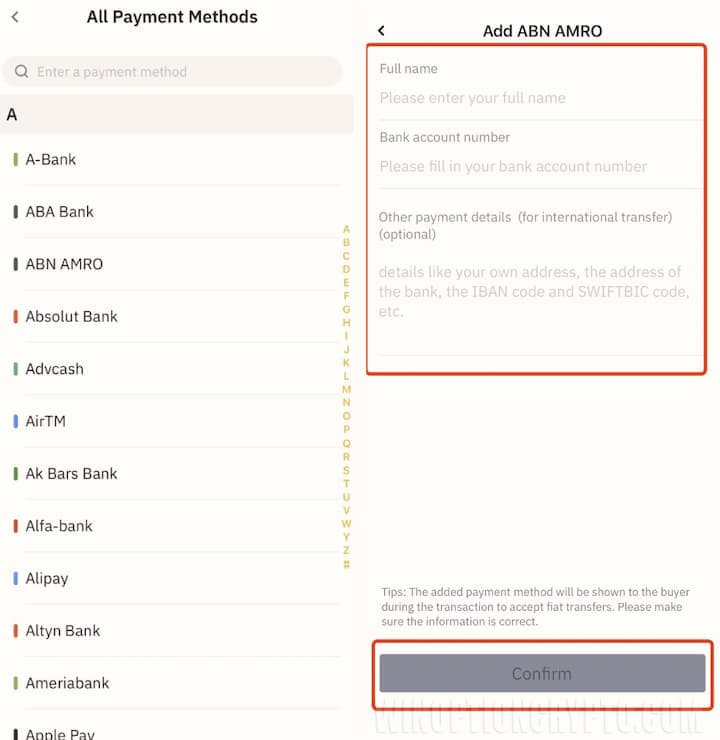

Step 4. Select the payment method and click the “Confirm” button. Available payment methods include: Sberbank, Tinkoff, Cash, Cash-in, Yandex Money, QIWI, Advcash, Payeer, SBP (fast payment system), Mir, Paypal, SEPA, SWIFT, Revolut, Perfect Money, Neteller, Payoneer, ApplePay, Alfa-Bank, VTB and others.

Step 5. Go to the P2P trading section. To do this, go to the “P2P Trading” menu from the main page.

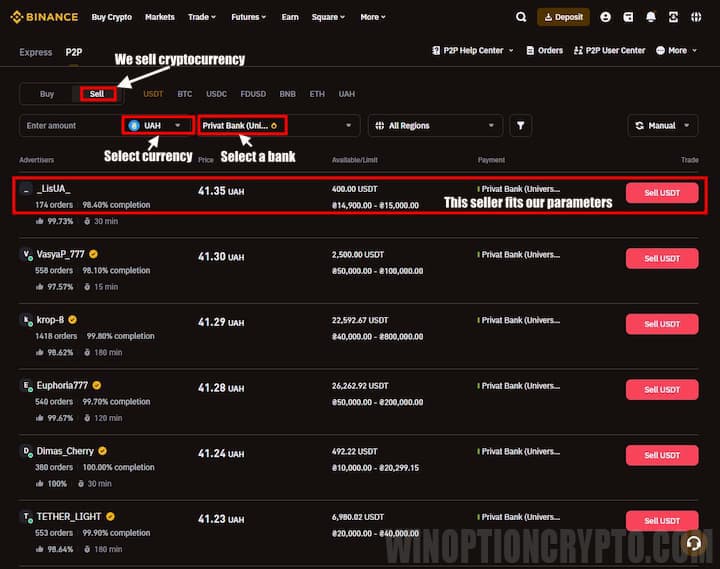

Step 6. Let's say we want to sell 400 Tether (USDT) for hryvnia and receive payment to a Privatbank card. To do this, we need to select a buyer with a suitable limit and payment method. Click the "Sell" button.

Step 7. Specify the number of coins you want to sell. Click the “Sell USDT” button to place your order.

Step 8. In the order information, you will find the time during which the buyer must make the payment. The payment window time can vary from 15 minutes to 6 hours and is set by the buyer when creating the ad. If any controversial issues arise during the exchange, use the built-in chat to communicate with the buyer and resolve the issues.

Please note! Do not transfer assets until you have actually received the money in your account. No amount of persuasion, urgency or even receipts with payment confirmation should induce you to transfer assets to the buyer. Check your bank account balance via online banking to ensure that the funds have arrived. Click the "Confirm Transfer" button only after you are sure that the payment has been received.

Choosing the Ideal Crypto Exchanger

A crypto exchanger is an online platform that allows you to exchange one cryptocurrency for another or fiat money (for example, USD, EUR or UAH). In addition, crypto exchangers allow you to transfer electronic money to various wallets such as WebMoney, QiWi or Skrill. They will also help out if you need to exchange bitcoin for the corresponding amount on a bank card.

Working with such platforms is very simple. Unlike cryptocurrency exchanges, many of them do not even require registration or verification. All you need to do is specify the transfer direction (for example, Tether TRC20 - Visa / Mastercard), the amount and your details. After confirming the transaction, the cryptocurrency exchanger will process your transaction and fiat money will be credited to your card account.

With the growing popularity of cryptocurrency exchanges, there are more and more people who want to earn money on commissions. How to choose a reliable exchanger and not become a victim of scammers?

Crypto Exchangers under a Magnifying Glass: Pros, Cons and the Best Options

Advantages of crypto exchangers:

- A quick and easy way to exchange cryptocurrencies for fiat money or other payment systems.

- They work around the clock, available at any time and from anywhere in the world.

- Wide choice of cryptocurrencies and fiat money for exchange.

- The ability to quickly find favorable exchange rates due to high competition between crypto exchangers.

- Many provide high levels of protection for users' funds and data.

- Most platforms offer customer support to promptly resolve questions and issues.

- Some exchangers allow you to conduct anonymous transactions without going through complex verification procedures.

Disadvantages of crypto exchangers:

- May charge high transaction fees, especially when exchanging large amounts.

- There is a risk of your wallets being hacked and being scammed by the exchanger, especially if you use little-known and unreliable platforms.

- Some exchangers may not comply with local laws and regulations. For example, in terms of exceeding the transaction limit, which is not subject to financial monitoring by banks, which can lead to legal problems for users.

- There may be limits on exchange or withdrawal amounts, which is inconvenient for users with large volumes.

- Some exchangers charge additional fees that are not disclosed in advance.

- Sometimes transactions may take longer than initially expected, especially when the platform is under heavy load.

- Not all cryptocurrency exchangers offer quality support to their customers, which can be a problem if there are problems with the transfer.

- In some situations, the exchanger may freeze the user's funds. For example, due to failure to pass the AML check of his cryptocurrency.

- The exchange rate on some platforms may be much less favorable compared to alternative exchange methods.

Choosing the best crypto exchange will largely depend on your individual needs and preferences. Here are a few factors to consider:

- Commissions – compare commissions of different exchangers to find the most favorable conditions.

- Security – choose an exchanger with a good reputation, a large number of positive reviews and reliable security measures.

- Functionality – make sure that the crypto exchanger has the transfer directions you are interested in.

- Restrictions – Check that the cryptocurrency exchanger does not have any restrictions that may prevent you from using it.

- Minimum order amount – not all exchangers work with small amounts. Therefore, make sure that your order meets this parameter.

To quickly find a suitable crypto exchanger, we recommend using special aggregator services such as “Kurs Expert” and “Best Change”.

Your First Exchange via a Crypto Exchanger: Step by Step

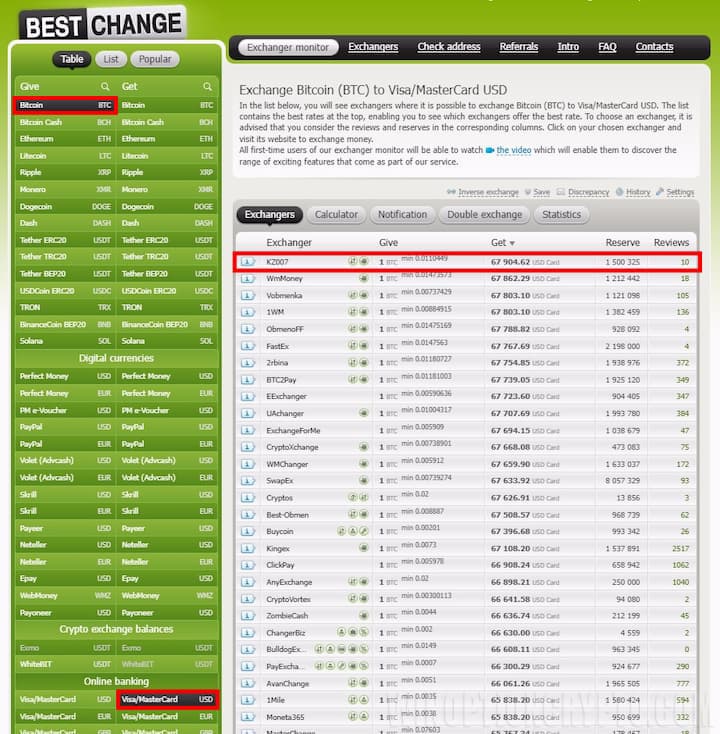

Let's look at how to exchange Bitcoin cryptocurrency for fiat money. Let's say we have 0.08 BTC and want to withdraw them to a Visa card.

Step 1. Open the website of the “Best Change” aggregator service and select a suitable crypto exchanger from the list that supports the transfer direction and amount we need.

When choosing a crypto exchanger, always evaluate:

- Exchange rate - the higher the rate, the more fiat money you will receive.

- Reserve – make sure that the exchanger has enough reserves of the currency you need.

- Reviews – read reviews from real users about the selected exchanger.

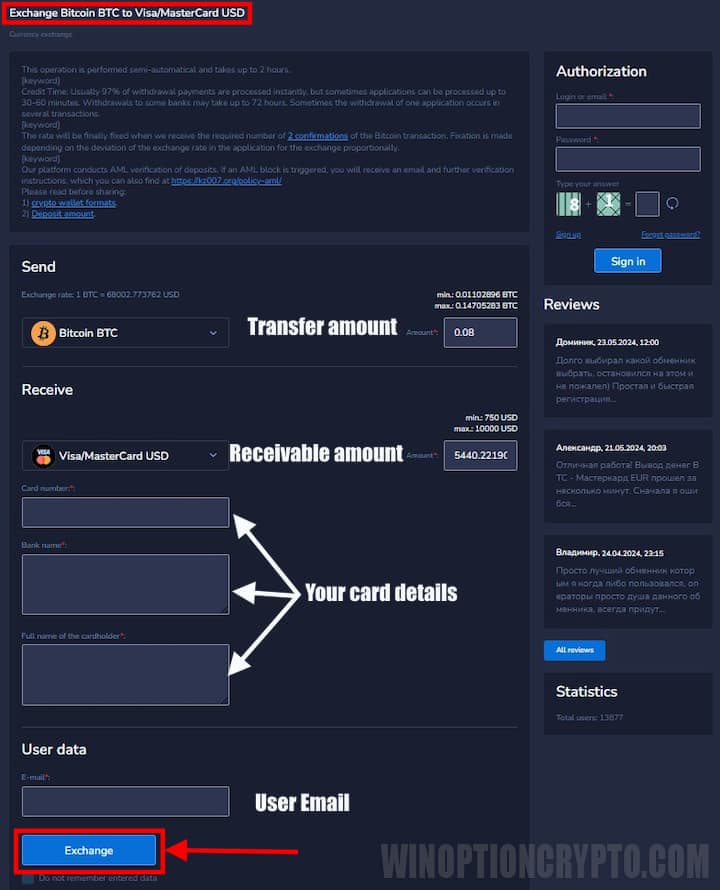

Step 2. Click on the offer to buy bitcoin at the highest rate, go to the crypto exchanger website and fill out a transfer application. Carefully check all the filled in details and click “Exchange”, confirming the exchange. If you often use the same exchanger, we recommend registering your account with it. Then you will not have to enter your data every time, and all your payment details will be automatically filled in from your account.

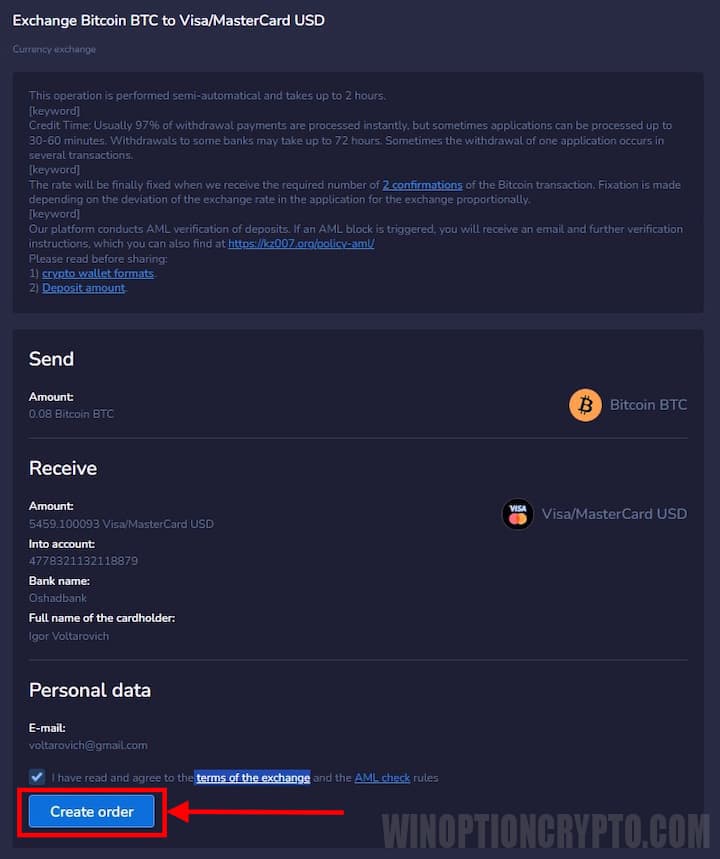

Step 3. Next, a page with your details will open so that you can check everything again. You are also asked to agree to the exchange rules of this crypto exchanger (you need to check the box next to the exchange conditions). Click the “Create order” button.

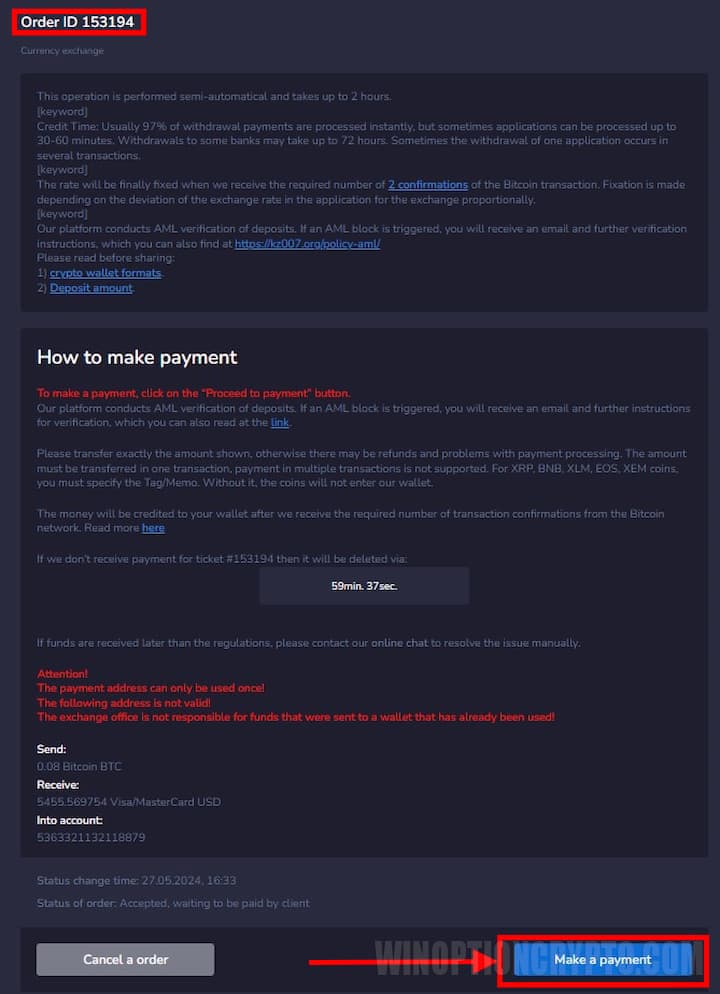

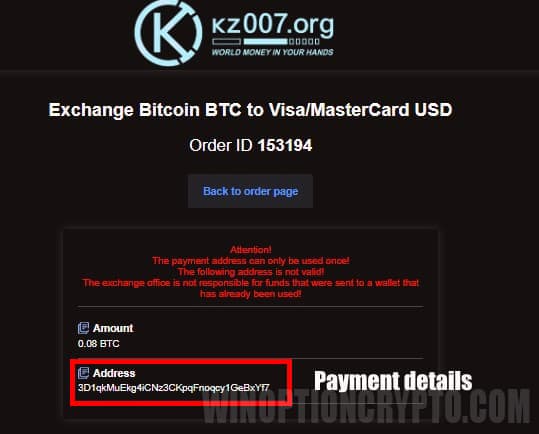

Step 4. A page with the assigned order ID appears. Click “Make payment”.

Step 5. Once you make the payment and the crypto exchanger receives BTC, it will send you USD to the details you specified when creating the exchange request. The transaction processing time may vary depending on the exchanger and the blockchain network load.

The Best Way to Exchange Cryptocurrencies: What is It?

The answer to this question largely depends on the preferences of each user. We recommend that you conduct your own small research before choosing the best exchange option. In doing so, evaluate factors such as exchange speed, fees, security, convenience, and availability.

|

Criterion |

Crypto exchanges |

P2P platforms |

Crypto exchangers |

|

Speed |

Fast (trades are usually processed within minutes) |

It may be slower (depends on the speed of searching for a counterparty) |

Fast (trades are usually processed within minutes) |

|

Commissions |

Can be high (depending on the exchange and type of transaction) |

Low or none (depending on platform) |

Can be high (depends on the exchanger) |

|

Safety |

High (exchanges use advanced security technologies) |

Medium (fraud risk) |

Medium (risk of hacking) |

|

Convenience |

Ease of use (intuitive interface) |

May be more complicated (requires registration and verification) |

Ease of use (intuitive interface) |

Conclusion

In this review, we looked at three of the most popular ways to safely and profitably exchange cryptocurrency for fiat money. We started with the concept of fiat currency and its differences from digital assets, then looked at popular cryptocurrency exchanges, P2P platforms, and crypto exchangers. We discussed the advantages and disadvantages of each platform, which will help you choose the best option depending on the goals, priorities, and financial capabilities of each user.

It is very important not to rush to conclusions, carefully study all available options, compare fees, exchange rates, user reviews and security measures before making your final choice in favor of one or another platform. Do not forget that exchanging cryptocurrency for regular money is just one of the steps in working with digital assets. On our website, you will find many other useful materials that will help you understand the features of the cryptocurrency market , teach you how to trade, store it safely and earn money with it.

See also:

How to buy cryptocurrency for rubles or dollars

Is cryptocurrency necessary in the modern world?

To leave a comment, you must register or log in to your account.