Most trading strategies are often overcomplicated in an attempt to make them more effective. This is a completely wrong approach: the more deeply the market features and trading ideas are analyzed, the more difficult it is to choose the right one at the key moment. Simplicity does not mean that the strategy itself is stupid and worthless.

Most of the simple strategies used by traders relate to the binary options structure. In this case, you can, having found out the basic principles of operation, apply them with constant success, without complicating it or studying technical details. One such strategy is the “Ladder” strategy, which works using just a candlestick chart.

Brief description of the "Ladder" strategy and characteristics

- Platforms and currency pairs: Any

- Timeframe: M5-H1

- Expiration period: 1 candle

- Trading period: sessions with Europe and America

- Optimal brokers: Alpari , Quotex , PocketOption , Binarium .

The very name “Ladders” is directly related to how exactly it is necessary to work with transactions using this strategy. The trader monitors the candlestick chart and makes decisions when a certain pattern appears on it, which looks like steps. It indicates changes during current trends.

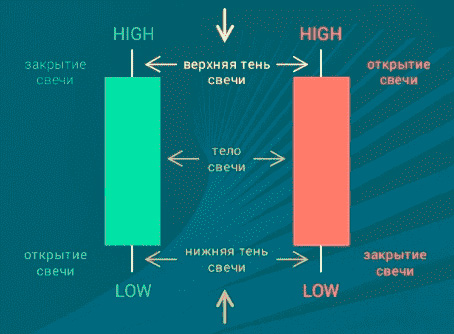

To work, you only need a chart that includes bullish and bearish Japanese candlesticks. Based on their movement, conclusions are drawn that allow the trader to trade effectively. These changes should be interpreted as follows:

- A bullish candle (marked in green on the chart) is an indicator of an increasing price.

- A bearish candle (marked in red on the chart) is an indicator of a falling price.

The optimal moment to start trading occurs when a trader sees that one of the candles overlaps the shadow of the one that went before it. This happens at moments of powerful turning points, when the market rapidly increases or decreases. This moment must be caught on time.

Basics of binary options trading using the ladder strategy

When purchasing a Call option, the following features arise:

- the appearance of a bullish candle with a slight shadow (i.e., the difference between the base and maximum price) on top;

- the next bullish candle covers the entire high and upper shadow;

- It is necessary to enter a rise after the candle is completely closed.

When purchasing a Put option, the following features arise:

- the appearance of a bearish candle with a slight shadow (i.e., the difference between the base and minimum price) from below;

- the next bearish candle covers the entire low and lower shadow;

- It is necessary to enter into a decline after the candle is completely closed.

Entry should be made only when the first candle appears, despite the fact that the same pattern can be repeated by several of them.

Special recommendations for trading

The strategy requires attention to the time period in which the trade will be carried out. Sessions with Europe and America are considered optimal due to high market activity. Trading at the very beginning of the session is not very useful - the volume is still very small, ideally you should wait about an hour.

Trading with this type of strategy is not carried out on the eve of news - during this period the market operates abnormally and does not comply with the rules of conventional analysis.

The expiration time always correlates with the current one and does not exceed 1 candle.

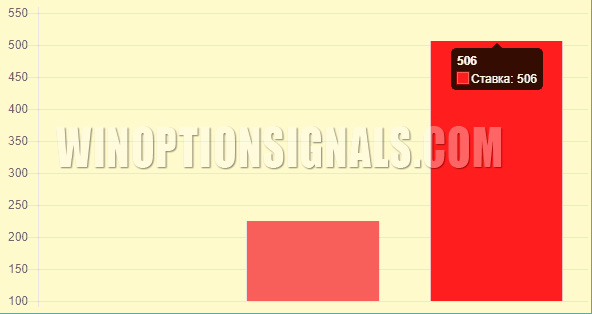

Transaction amount calculation

You should not take risks if the probability of loss is 4% or more of the deposit account. When opening an unsuccessful bet, it is better to move on to the next one according to the Martigail principle, without opening more than 2 legs. This can save your deposit.

To correctly calculate the bet, you can work with Martingale calculator . It calculates based on the options return and maximum loss. This allows you to determine a bet of $225, and then $506, with an initial bet not exceeding $100.

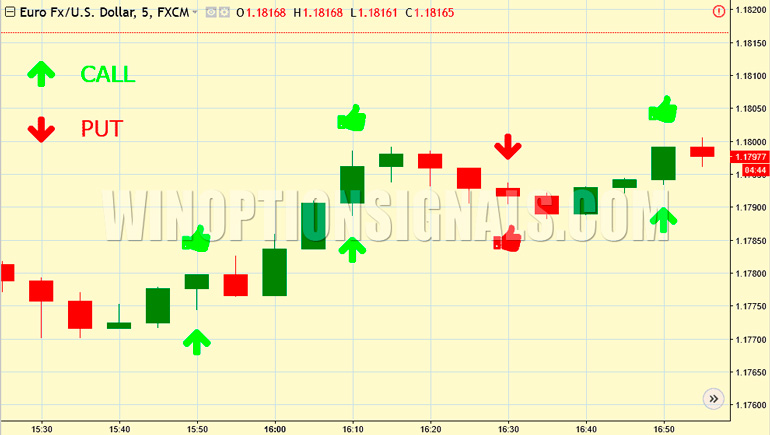

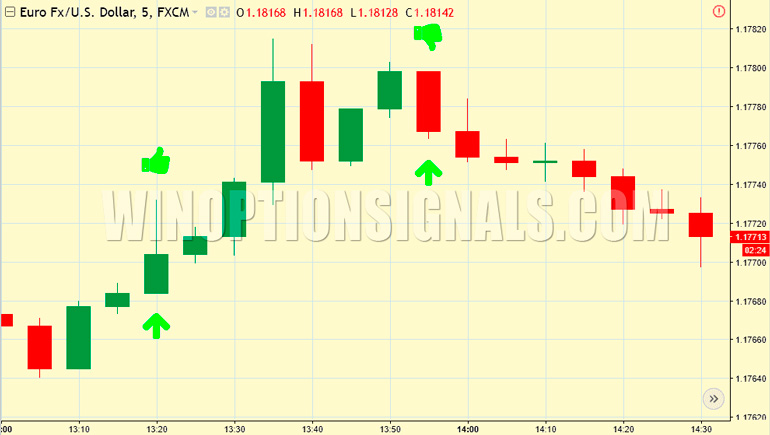

Examples of transactions

If there are regular movements, the market will be regularly updated with new trading signals. It is important to take into account that true signals appear only during busy European and American sessions. With sluggish movement with small candles, the result will most likely be false.

This trade demonstrates the profitable closing of the first option. Moreover, after the second call, the transaction no longer brought anything useful. The thing is that the second purchase of the option was carried out during price consolidation. It was positioned in a horizontal rather than “stepped” structure and encountered natural price resistance which caused it to reverse. It is necessary to pay attention to such details when concluding transactions, no matter what direction they relate to: if the price may encounter serious resistance, trading is unlikely to be profitable.

Summarizing

Using the “Ladder” is a way to quickly and easily learn how to work with the binary options system and get involved in trading them. To improve efficiency, you need to rely on the tips above and avoid working during sluggish session periods. You should not work in cases where the market is aggressive or is waiting for explosive news.

Everything else (trading assets and the choice of a specific time period for trading) remains at the discretion of the trader. This makes the Ladder one of the most flexible ways to trade binary options.

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionSignals , where we will definitely answer all your questions in the video.

To leave a comment, you must register or log in to your account.