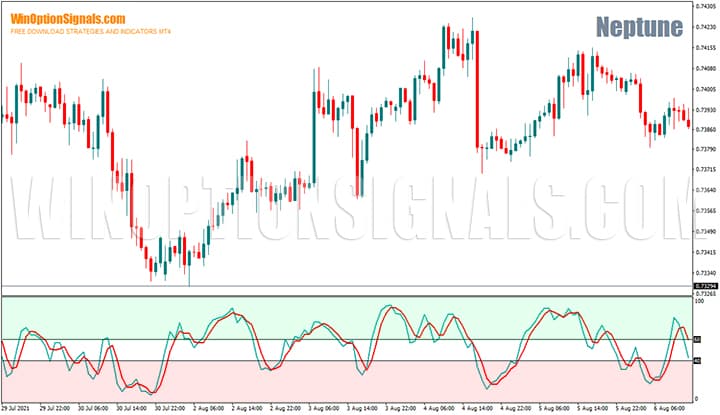

The effective and profitable Neptune strategy was initially used in the Forex market for short-term trading, but has recently proven itself successfully in the binary options market thanks to simple and accurate signals .

Despite the fact that this is a scalping system, it is used for medium-term trading on binary options. According to the testing results, the strategy showed the best results on the H1 timeframe .

It is known that average time periods are the most comfortable for trading. There is no need to constantly be at the monitor, as is the case with charts M1 and M5, which reduces the emotional stress. For traders with minimal experience, this trading mode is considered safer. It is better to use simple strategies and get 1-2 quality entries per day than to chaotically make 20 trades a day and tie yourself to the monitor, which will ultimately lead to emotional burnout.

Characteristics of the Neptune strategy for binary options

- Terminal: MetaTrader 4 .

- Timeframe: H1.

- Expiration: 4 hours.

- Types of options: Call/Put.

- Indicators: Williams %R.ex4, Stochastic Oscillator.ex4, Envelopes.ex4.

- Trading instruments: currency pairs , cryptocurrencies , stocks, commodities.

- Trading hours: 9:00-19:00 Moscow time.

- Recommended brokers: Deriv , Quotex , PocketOption , Binarium .

Installing Strategy Indicators for Neptune Binary Options in MT4

Indicators are installed as standard in the MetaTrader 4 terminal.

MetaTrader 4 instructions for installing indicators:

A template for setting up the Neptune strategy can be downloaded at the end of the article.

Review of Neptune strategy indicators for binary options

Let's look at each of the indicators one by one and what signals they generate.

Williams %R. The indicator , which is also called the Williams percentage range, is a simple but effective oscillator of the speed of price movement. In the indicator settings, set the indicator period to 50 and set levels with negative values (-20, -80). If the price stays within these values, it means a strong impulse movement, bearish or bullish trend .

Stochastic Oscillator . In the settings, we set the construction period to 5,3,3 and add levels 40 and 60. The indicator data serves as an additional signal, and, as in the case of the Williams %R indicator, shows the strength of the price movement: the longer the indicator lines are within the 40 or 60 zones, the stronger price impulse.

Envelopes. The indicator is a corridor of moving averages . Before plotting the envelope on the chart, you must set the settings to period 50, deviation 0.1, MA method – Simple Moving Average. If the candle closes above the envelope, this is the first signal that the price will rise. If the candle closes below the envelope, it is a signal for a possible price decrease. A long stay of the price inside the envelope indicates the presence of a flat in the market, in other words, when the price is in the corridor and does not move in any direction.

Trading rules for the Neptune binary options strategy

The rules of the strategy recommend buying Call or Put contracts strictly according to the trend. Trading in the direction of the trend is characterized by minimal risk and high profitability.

To determine the trend, the direction of the Envelopes envelope and the position of the price relative to its borders are used: if the price closes below the envelope border, this is a signal to buy a Put contract; if the price closes above the envelope border - a signal to buy a Call contract.

Envelopes are used to determine trend, but they are not the only or best trend indicator for binary options .

The moment of buying binary options, or in other words, the entry point, is determined by the readings of the Williams %R and Stochatic indicators: finding the indicator lines below the levels (-80 and 40) means buying a Put option, above the levels (-20 and 60) means buying a Call option.

We buy an up option (Call) if the following conditions match:

- The asset price is above the Envelopes.

- The Williams %R indicator line on the current candle has risen above the -20 level.

- Both stochastic lines rose above the 60 level.

If these conditions are met, we conclude a deal (Call) with an expiration of 4 candles – 4 hours.

Using the example of the Pound/Dollar currency pair , the price closed above the envelope border several times, but without confirmation from the Williams %R indicator. As soon as the indicator line went beyond the upper limit of the -20 value, it was a completed signal, after which it was worth buying a Call contract.

We buy a down option (Put) if the following conditions match:

- The asset price is below the Envelopes.

- The Williams %R indicator line on the current candle has dropped below the -80 level.

- Both stochastic lines went below level 40.

If these conditions are met, we conclude a sell deal (Put) with an expiration date of 4 candles.

An example of buying a Put contract demonstrates the ideal synergy of the system indicators when the price closed below the required zone simultaneously with the indicator lines. This is probably one of the best examples of quickly entering the market almost at the beginning of an impulse movement and with minimal risk.

Horizontal support and resistance levels will help filter out some losing trades and improve the overall performance of the strategy.

In the chart below (Pound/Dollar, H1 timeframe), the price bounced off the support level and then sharply rushed up. A price rebound from the support level is a strong signal when using horizontal support and resistance levels, and in combination with signals from the Neptune strategy indicators, it can even differ in accuracy up to 80%.

Support and resistance levels are quite difficult to find on the chart yourself, especially for beginners in trading. Therefore, we advise you to pay attention to indicators of support and resistance levels , which automatically draw horizontal levels for you.

Conclusion

The considered Neptune strategy has proven itself to be a reliable and simple tool for obtaining stable profits. Due to simple and understandable signals, it will be useful in trading for both experienced traders and beginners.

It is necessary to adhere to simple recommendations: do not trade when the market is in a sideways movement (flat) and choose a trading session when the market is most active. The optimal time for trading is 9:00-19:00 Moscow time.

The trading system can be used on almost any financial instrument, but beginners are recommended to start with major pairs (GBP/USD, EUR/USD, USD/CAD, USD/CHF) until their trading skills reach a better level. You should also not forget about money management , without which the existence of any strategy is impossible. The maximum risk per trade should not exceed 5% per trade.

Still haven't chosen a good broker? The rating of the best binary options brokers provides up-to-date information about broker services in the CIS: the number of assets for performing exchange transactions, welcome bonuses for new clients, availability of licenses, and most importantly – reviews from real clients.

Download the Neptune binary options strategy

Can't figure out how this strategy or indicator works? Write about it in the comments to this article, and also subscribe to our YouTube channel WinOptionSignals , where we will definitely answer all your questions in the video.

See also:

Technical analysis in binary options trading

To leave a comment, you must register or log in to your account.