Today, binary options (BO) have become one of the main financial instruments that private investors use along with stocks and other assets to make a profit. Binary options open up ample opportunities for earning money, which in the modern economy, with proper preparation and the availability of appropriate skills, can become high. However, many traders try to avoid this type of financial instruments, since they do not know the history of the appearance of binary options.

In a sense, binary options are a relatively simple way to make money. The fact is that working with this financial instrument requires constant access to the Internet and knowledge in the field of trading. The peculiarity of binary options is that the possibilities for earning money are not limited to just one asset. Using this tool, you can earn money by trading stock indices, currency pairs , stocks, cryptocurrency and others. Binary options are considered a highly profitable asset, which, under certain conditions, can bring up to 92% of net profit per transaction.

Binary options: history of appearance

If you delve into the essence of the concept of “binary option”, it becomes clear that they began to work with such assets in ancient times, but this term appeared later. According to the documents found, the history of the emergence of binary options began in ancient times, when people used special contracts (which, in fact, are an analogue of binary options) to carry out purchase/sale transactions between parties with goods at a pre-agreed price and within a certain period.

For example, historians have found an agreement between the inhabitants of Ancient Rome. This document states that one of the parties (the olive supplier) undertakes to supply olives to the other party during the season, in return for which they receive goods necessary for running this farm.

Despite the similarities between the described contracts and binary options, the mechanism of action of both financial instruments is essentially different. But similar agreements that were concluded in ancient times, as the history of binary options shows, laid the foundation for the creation of a new structure that allows today to make money on the foreign exchange market or exchanges.

History of exchange binary options

As the history of exchange binary options says, in the form in which they are presented today, they first appeared in the 20s of the last century. Over time, this financial instrument became more popular, but rapid development was hampered by a number of restrictions that traders had to put up with. In particular, to carry out transactions with binary options, the parties had to agree on all aspects of the agreement being concluded.

The situation changed dramatically in 1973, when the Chicago Board of Trade launched its namesake options exchange (CBO). This decision radically changed the mechanism for working with these financial instruments. Thanks to the launch of the BBO, traders did not need to conduct preliminary negotiations with sellers and buyers on the terms of the contract. The appearance of the Chicago Exchange in the history of binary options led to the fact that the trading mechanism for this financial instrument was standardized, thereby simplifying operations with these contracts and significantly increasing their efficiency.

The situation changed dramatically in 1973, when the Chicago Board of Trade launched its namesake options exchange (CBO). This decision radically changed the mechanism for working with these financial instruments. Thanks to the launch of the BBO, traders did not need to conduct preliminary negotiations with sellers and buyers on the terms of the contract. The appearance of the Chicago Exchange in the history of binary options led to the fact that the trading mechanism for this financial instrument was standardized, thereby simplifying operations with these contracts and significantly increasing their efficiency.

The result of this market transformation was the emergence of specialized binary options brokers who offered their clients new trading platforms. Standardization of the trading process has led to another consequence: the number of fraudulent brokers in this market has decreased. The fact is that after the launch of the ChBO, brokers were forced to conduct transactions with client accounts, focusing on the rules and regulations in force in the given market. Thanks to this, the number of risks faced by private investors working with binary options has decreased.

The development of this segment of the financial market did not stop with the launch of the Chicago Stock Exchange. In 2012, the Cyprus Securities and Exchange Commission (CySEC) , which is the regulator of the European financial market, included binary options in the list of financial instruments. This decision once again confirmed the legality of transactions carried out with such contracts.

History of Online Binary Options Trading

Binary options received maximum development after the number of Internet users began to grow. The first websites for trading these financial instruments appeared in the late 90s, and this was a key moment in the history of binary options, as it brought many new investors into the market with relatively low incomes. That is, the digitalization of operations with binary options has opened up for the masses of people unfamiliar with such financial instruments the opportunity to make money on binary options in real time, without leaving home.

In the early 2000s, there was a noticeable growth in dealing centers, which improved trading conditions through the introduction of new technologies. At the same time, the number of underlying assets on which binary options are based has increased. Today, this market segment continues to develop, and exotic types of digital contracts have already appeared.

Myths in the history of binary options

There are many myths about binary options around the history of binary options, most of which boil down to the fact that trading these contracts is simple and can bring a lot of money with minimal investment. But as soon as a person who believes such statements begins to work with digital contracts, he almost always loses his deposit . Because of such cases, messages often appear on the Internet that binary options are a scam .

Such situations can be explained by the fact that binary options are traded for money in real time. This type of activity, like others, requires certain training, knowledge and skills. Moreover, trading binary options is in some cases more difficult than trading stocks or other assets, since it can be difficult to predict the direction of price movement within a limited expiration time (1, 5, 10 minutes, etc.).

Such situations can be explained by the fact that binary options are traded for money in real time. This type of activity, like others, requires certain training, knowledge and skills. Moreover, trading binary options is in some cases more difficult than trading stocks or other assets, since it can be difficult to predict the direction of price movement within a limited expiration time (1, 5, 10 minutes, etc.).

As a result, people who believe that trading is a kind of analogue of a casino get excited and quickly lose money. Such traders, driven by emotions, blame binary options brokers, the market and other factors for their losses, but not themselves.

Binary options trading is carried out within certain rules that must be followed. This type of trading requires constant analysis of the behavior of the market as a whole ( technical analysis and fundamental analysis ) and individual assets in particular. It is impossible to quickly make money on binary options, like in a casino, since in this case you need to learn how to correctly predict the behavior of the exchange rate, and not guess the direction.

How to make money on binary options

To start making money on binary options, you need to select a broker whose terms of cooperation meet the specific needs of the trader and register on the company’s official website. This procedure is usually straightforward, as the user basically needs to provide personal information and a phone number to secure the account.

At the next stage, it is recommended to re-read the terms of cooperation with the broker and undergo training in binary options trading. At the same time, you should turn to ready-made strategies for binary options , as well as indicators that simplify trading. As a trader gains experience, he can develop his own binary options trading methods .

At first glance, this type of trading is a simple and fast way to earn high income. But in practice, the situation looks different, since making money on binary options requires an integrated approach, which involves analyzing the market and price movements of individual assets, choosing the right time to open and close a transaction, and more. However, a number of novice traders, when starting to trade binary options, often intuitively carry out transactions, forgetting the advice of professionals.

To put it simply, the essence of this type of trading comes down to the following: the trader needs to understand whether the price of the selected asset will go up or down within a given period of time. Unlike trading stocks or other similar financial instruments, there is no need to determine the exact price to make a profit.

To put it simply, the essence of this type of trading comes down to the following: the trader needs to understand whether the price of the selected asset will go up or down within a given period of time. Unlike trading stocks or other similar financial instruments, there is no need to determine the exact price to make a profit.

For example, a trader chose Apple securities as the underlying asset. By placing an order to buy a binary option that provides for the stock to rise within 15 minutes, he will receive earnings even if the price increases by 1 point. The size of payments for one transaction directly depends on the terms of cooperation with a specific broker. Earnings (or fixed income) are usually 60-92% of the investment amount.

It should be noted that today brokers are not limited to this type of binary options . There are, for example, digital contracts that bring profit in cases where the price for a given period of time has overcome a certain limit (strike options). At the same time, expiration periods (that is, the period after which the transaction is automatically closed) are in most cases standard and amount to 1, 2, 5, 10 or 15 minutes, an hour, a day of the week, and so on. But some brokers are ready to offer other terms of cooperation.

The size of the investment in the transaction also varies depending on the chosen company. Some brokers allow you to buy digital contracts for $1, others require more.

Some traders believe that such companies benefit when their clients lose money. But in practice this is not always the case. Brokers receive a certain percentage of completed transactions, regardless of whether the trader received income from the operation or not. For example, two players opened an order to buy a binary option by investing $100. The first trader guessed the price direction and received 70% of the amount as income, the second trader made a mistake with the forecast and lost all $100. In both cases, the broker receives the same commission of 30%.

The income of such companies directly depends on the number of clients. That is, in reality, it is beneficial for the broker that traders make money, since those who constantly lose money leave the market early.

Binary options trading

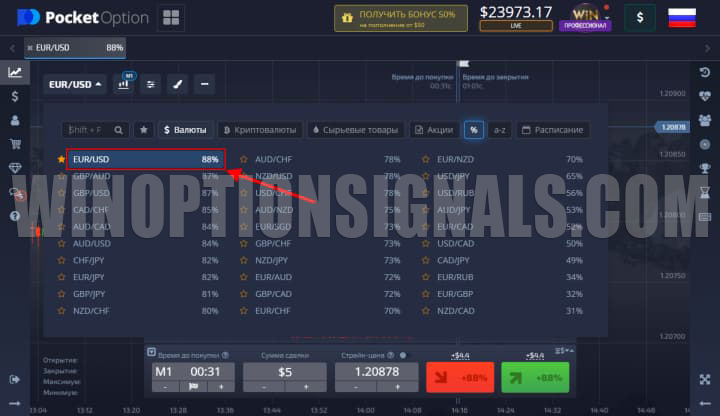

As an example to help you understand the features of binary options trading, you can consider the terms of cooperation with the broker Pocket Option . This company allows you to evaluate the capabilities of the proposed trading platform before registering on the site. But to trade binary options you need to open your own account with PocketOption.

The procedure for concluding transactions with such financial instruments is as follows:

- An asset is selected in the broker’s trading platform (the EUR/USD currency pair is taken as an example):

- The time for closing the transaction is indicated (for example, after 15 minutes):

- The direction of price movement is set. That is, you need to determine whether the stock price will rise or fall in 15 minutes, that is, you need to click on the Call (“Higher”) or Put (“Lower”) button:

If at the end of 15 minutes the prices for the selected currency pair rise by at least 1 point, then the trader on this transaction will receive a profit of up to 95% of the investment amount.

Call Options (“Higher”). Let's say a trader, based on the results of the analysis, understands that in the near future the prices for Facebook (FB) shares will rise. In this case, he buys a Call option.

For example, we can consider the case when the shares cost $200.39 before opening the transaction. If within 10 minutes (selected expiration date) quotes rise above the specified value, then the trader receives a profit in the amount set by the broker (for example, 81%). If the price per share stops below $200.39, the investor loses all the money invested in the transaction.

Put options (“Below”). If market analysis has shown that the price of a certain asset will fall in the near future, then in such cases an order is placed to purchase a Put option. For example, you can take the GBP/USD currency pair. Let's assume that technical analysis showed that within the next 5 minutes this currency will fall below its current value. The trader buys a Put option with an expiration of 5 minutes, and if the price drops by 1 point or more from the moment the transaction was made, the trader will make a profit.

How to predict prices in binary options

Forecasting prices for assets underlying binary options involves performing a set of measures using methods of technical and fundamental analysis. For example, the stock price may depend both on investors' expectations of future events, as well as on the situation on the local or global markets, decisions of the company's board of directors and other factors.

Let's say Volkswagen says that in the near future it is preparing several interesting cars for the European market, which, according to published information, will be in high demand. After the publication of such news, the share price of the German company will definitely go up. If, at the time of the release of this information, a trader opens a deal to buy a Call option on this security, then at the end of the expiration date he will definitely receive income.

Benefits of binary options

Traders highlight several clear advantages of binary options over other assets:

Traders highlight several clear advantages of binary options over other assets:

- Simplicity . As noted earlier, in order to make money on binary options, it is necessary to determine the direction of price movement, when, as when trading shares, you need to set the value of the exchange rate, because the amount of income depends on this. Digital contracts allow you to make decisions and guess the movement of the exchange rate without delving into the study of the features of a particular asset.

- Availability . Thanks to binary options, investors with a relatively small amount of money can enter the exchange. Trading in the financial markets of stocks, bonds and so on requires large initial investments.

- Profitability . The amount of profit you can make from binary options trading is unlimited. Moreover, in this case, with a properly structured strategy, the daily income can be significantly higher than when working with securities.

Binary options strategies and indicators

The success of binary options trading is determined by the effectiveness of the analysis performed. To do this, special strategies are used that allow one to predict the direction of price movement with relatively high accuracy. Technical analysis is more often used in binary options trading, since positions in digital contracts are usually closed quickly (5, 10 or 30 minutes).

Experienced traders advise beginners at the initial stage to focus on working with strategies that are based on the market trend . As practice shows, if the rate of a certain asset moves up within, for example, half an hour, then in the next 10 minutes it most likely will not change.

However, it is better if the trader simultaneously uses several strategies that significantly increase the accuracy of the forecast. For example, at the moment, to determine the point to enter the market, the player uses an indicator based on the Stochastic oscillator . This technical tool often gives erroneous signals, so it should be checked, for example, using Moving Averages . Signals received from two or more indicators are always more accurate.

Conclusion

As a result, you can see that the history of binary options dates back to ancient times, even though transactions were not called that way back then. Despite this, the history of binary options has evolved and now this financial instrument is much more functional and effective than before.

Having understood the essence of binary options and the features of working with digital contracts, traders discover new opportunities for almost unlimited earnings. It should be taken into account that this financial instrument does not allow you to constantly make a profit, based only on intuition and guessing the direction of the exchange rate. The profitability from operations with binary options directly depends on how accurately the forecast of price changes is made, which can be done using methods of technical and fundamental analysis.

See also:

Do you make money on binary options?

Psychology in trading - what does a beginner need to know?

To leave a comment, you must register or log in to your account.