At the first stages of working with any financial assets, including binary options , traders often make the same type of mistakes . This is mainly due to lack of experience. Advice to traders from professionals who reveal the rules that must be followed helps traders avoid such mistakes. Without this, learning to successfully trade financial assets will be much more difficult.

Content:

- Avoid hasty decisions;

- You need to take responsibility for your decisions;

- Start trading only with a demo account;

- Do not use universal strategies;

- Bonuses from brokers may result in losses;

- A trading journal is a must-have tool for a successful trader;

- Trading discipline determines success;

- Create a trading plan before starting trading;

- You need to develop strategies for yourself;

- You can trade for an amount that you don’t mind losing;

- You cannot stop learning;

- You can't stop watching charts and price movements;

- You need to learn the basics of trading gradually;

- Avoid scammers;

- Open transactions only after reading the terms of the agreement with the broker;

- Be sure to verify your account.

Avoid hasty decisions

Often, beginners, having received certain knowledge, strive to apply it in real trading conditions. However, professionals do not recommend starting trading right away. The global market will continue to operate regardless of the current circumstances. For beginning speculators, it is important to form a certain foundation of knowledge that will help them develop successfully and determine the direction of their future activities. Thanks to this, in particular, it is easier for users to understand which assets are more profitable for them to work with, taking into account personal qualities and other circumstances.

Experienced traders work in financial markets. That is, this source brings the main income. This type of activity is always associated with high risks, which, without following the rules of trading, quickly lead to the trader losing all his capital. This is why beginners should not immediately open trades after understanding only the general rules of trading in financial markets. Without a certain amount of knowledge and experience, it is impossible to reach a level at which the majority of transactions will cover the loss. That is, a foundation is needed through which a trader will learn to receive a constant income from transactions with financial assets.

Beginners are advised to spend most of their time gaining additional knowledge rather than gaining experience. The success of trading at the initial stage depends on this. The amount of knowledge acquired also determines the speed with which a person learns to earn money and the amount of income.

Trading is a full-fledged profession that requires in-depth study. Trading the financial markets can be very profitable over time. However, success in this area accompanies those who spend a lot of time on this type of activity. One becomes a professional in trading after several years of constant training. This applies not only to reading specialized literature . Knowledge is acquired by trading on a demo account, studying the strategies and behavior of professionals.

You need to take responsibility for your decisions

A number of binary options brokers offer an option such as copying trades. This function implies the following: a trader places an order with the same parameters (amount, asset type, expiration date, etc.) as an experienced speculator. This approach can bring good profits.

However, success in financial markets accompanies only those who open transactions based on their own forecasts. It is important to understand that only the trader is responsible for every decision. Even when copying trades, a person must understand that in case of failure, it is he who loses the money. Therefore, when opening each order, you must accept responsibility.

This applies equally to trading signals. The companies that develop them provide information about the possible direction of the market, based on their own judgment. But it is up to the trader to decide whether to use trading signals or not. This also applies to PAMM accounts, trust management and other instruments offered by brokers.

Without making their own decisions, traders simply give money to third-party companies, hoping for luck. By taking risks, the speculator thus gains additional knowledge and gains experience. This helps to avoid mistakes in the future and, as a result, increase your earnings.

Start trading only with a demo account

A demo account is a free tool available from most brokers that helps you understand the nuances of trading. However, this option is useful especially for beginners. As the advice of successful traders says, constantly working with a demo account can ultimately be harmful.

The reason is that this type of trading is carried out with virtual money. That is, for funds that do not belong to the user. At the same time, thanks to a demo account, people learn the basics of trading. This tool allows you to trade assets at the real rate without risking your own money. A demo account is also used to test strategies.

But when working with such an instrument, a trader does not experience the stress that occurs when trading with real money. This is due to the fact that this trading format does not carry any risks. As a result, a person does not develop the fear of losing money due to wrong decisions. In the future, after switching to a real account, the speculator will not carefully place orders, checking the accuracy of his own forecasts.

Therefore, trading on a demo account is recommended only to gain first experience. After the user understands the features of trading, you can move to the real market and open transactions with your own money. However, at the first stage it is recommended to place orders with a minimum rate, trying to reduce losses due to lack of experience.

Don't use universal strategies

Among a number of traders there is an opinion about the existence of the so-called “Grail” of trading . This means a universal strategy that will generate income in 100% of cases. Because of this, some users work using only one or several methods, not paying attention to the current state of the market. Others spend years finding the right combination of indicators and other analysis tools that will consistently generate profits.

However, all the advice to novice traders suggests that there is no universal strategy that is suitable for all forms of trading and remains effective regardless of market behavior. In reality, course behavior can only be predicted using the tools and experience at your disposal. But it is impossible to predict exactly how the price will change.

It is believed that a strategy that gives a positive result in 70% of cases is optimal. It is impossible to change such a trading method to a more effective one.

When starting to trade with real money, you should avoid tempting offers of a short-term increase in profits by several hundred percent. Such income cannot be obtained in a short period of time.

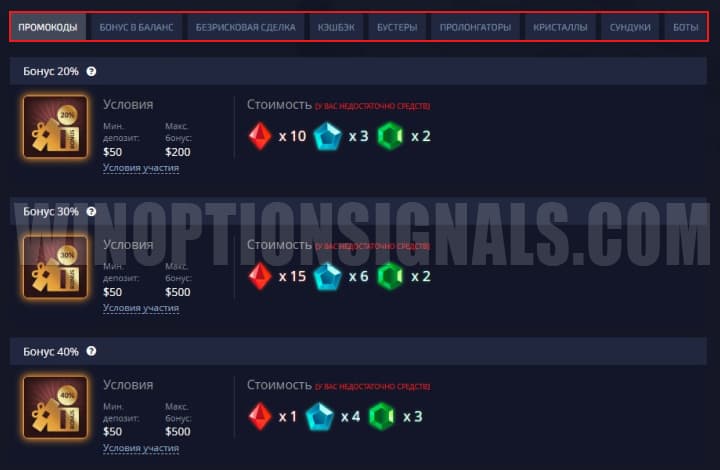

Bonuses from brokers can lead to losses

Many brokers offer a variety of bonuses in order to attract new clients and retain old ones.

But before taking advantage of such benefits, it is recommended that you familiarize yourself with the terms and conditions of their provision. Most companies offer what is called a welcome bonus. In this case, the trader receives a certain amount when funds are credited to the internal balance.

This type of bonus is considered harmless. The client receives additional funds that can be used in trading. If the user places money for withdrawal before the bonus is worked out, then the accruals are lost. That is, this money cannot be sent to your account.

However, some brokers, when providing bonuses, immediately block the balance until certain conditions are met. In such cases, the trader cannot withdraw money. Basically, these conditions provide for transactions with a certain trade turnover, the size of which can exceed the initial amount by 35-50 times or more. For example, when receiving a bonus of $100, the user must conduct transactions for $5 thousand. In this case, the likelihood of losing all your money is high, especially for beginners.

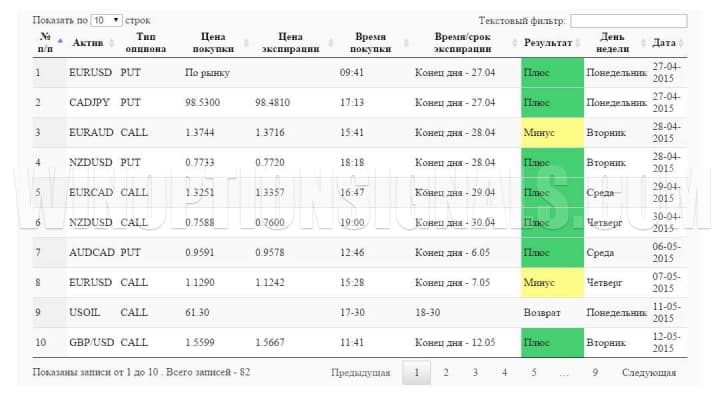

A trading journal is a must-have tool for a successful trader

A trading journal (trade journal) is an important tool for analyzing a trader’s activities. It is here that you can quickly find out at what point the chosen strategy began to bring losses.

Also, with the help of the journal, it is possible to determine the optimal time interval during which the trading method constantly brings profit, the types of profitable assets and find out other information. In addition, by analyzing the records, you can understand how to change your approach to trading to increase income or avoid losses.

In addition, some traders use the trading journal as a trading diary . That is, users reflect their own state when making certain transactions or in a specific market situation. Thanks to the magazine, people understand when and what emotions arise. This will provide additional opportunities to work on yourself. Emotions only interfere with trading operations.

Trading discipline determines success

Trading discipline involves performing certain actions according to a pre-developed algorithm. For example, if a trader does not close trades until nine in the morning, then even in the presence of a favorable situation he continues to follow this rule, regardless of the reasons that prompted him to work later than the specified time.

This approach allows you to minimize losses over time and increase income where possible. Discipline helps you achieve results in the market. To avoid mistakes leading to losses, you need to:

- strictly adhere to the principles of the chosen strategy;

- refuse to trade if there are several losing trades in a row;

- comply with the principles of risk management (that is, invest no more than a certain amount in a transaction);

- follow the daily trading plan;

- strive to reduce the influence of emotions on transactions;

- strive to improve trading results.

Stable earnings in financial markets are impossible without a disciplined approach.

Create a trading plan before starting trading

Thanks to a trading plan, a trader protects himself from unexpected risks. It is recommended to draw up this document (list or otherwise) before opening the first transaction. The trading plan must indicate:

- trading time;

- type of strategy used;

- minimum (maximum) amount of investment in one transaction;

- tactics of behavior in cases where trading operations bring losses;

- goals for the day;

- maximum amount of loss.

By adhering to such a plan, you can avoid many mistakes. It also creates discipline, which, as shown above, helps increase profits.

You need to develop strategies for yourself

It is necessary to trade only with the help of those strategies, the principle of operation of which is clear to the trader. This can be achieved by studying the features of indicators. You should also always check the effectiveness of the signals provided by the chosen strategy.

If any errors occur or you don’t like the method, you need to:

- remove or replace the indicator (oscillator);

- change the time interval during which transactions are opened;

- change the conditions for opening transactions.

Each strategy must correspond to the characteristics of a person’s character. In particular, these can be techniques that are effective over long or short time intervals, high or low risk, and so on. It is important to choose each strategy for yourself. You cannot adapt to the trading methodology, even if it gives positive results to other users in 70% of cases.

You can trade for an amount that you don’t mind losing

Trading is a high-risk activity. The possibility of losing your entire capital in financial markets never goes away. Trading is not able to solve problems associated with a lack of money. You cannot expect that by trading assets you will be able to repay loans and get rid of debts.

All experienced and successful speculators open transactions only for those amounts that they are willing to lose. Thanks to this, users do not experience fears before transactions. This approach allows you to focus only on trading operations, excluding emotions. This method also allows you to choose a strategy that will preserve capital during unprofitable transactions (so-called drawdowns).

Market professionals do not recommend starting trading with a minimum deposit (usually $10). In this case, it is impossible to comply with the rules of risk management. Beginners are recommended to start trading with 50-100 dollars, investing a minimum amount (from 0.5 to 1 dollar) in one transaction. With this format, periodic losses will not lead to the loss of all capital.

You can't stop learning

Learning to trade is an ongoing process. Professionals are constantly finding new ways to trade, studying different techniques and performing other activities aimed at increasing their knowledge. This allows you to reduce the number of errors.

Trading books are considered an important source of information. Moreover, professionals read works written several decades ago. Despite the development and digitalization of world markets, the principles of trading have not changed since that time.

However, all information must be filtered. On the Internet and other sources, you can often find the opinions of experienced traders who, in reality, only have certain knowledge about the market, but have never made successful transactions. It is important to check the information received on the chart without risking your own money.

Among such “professionals,” the Martingale method is considered popular. This approach, according to the statements of such “gurus,” helps to make a profit even in an unstable or declining market. But the Martingale method only brings losses.

Can't stop watching charts and price movements

Understanding technical analysis is necessary for every person who decides to make money in the financial market. The tools used in this case help to understand the direction of price movement during a certain time interval. According to professionals, to master technical analysis, you need to spend at least 10 thousand hours tracking a chart.

During this time, the human brain absorbs all the necessary information. As a result, the trader learns to automatically (intuitively) find signals on the chart that help determine points for entering the market.

You need to learn the basics of trading gradually

There is a lot of information about trading in financial markets today. In an effort to study everything, you can get confused in terms, trading principles, and more. Therefore, information about trading must be absorbed gradually. First you should learn the basics of trading, then:

- risk management ;

- trading psychology and discipline;

- technical analysis (chart analysis);

- fundamental analysis ;

- trading techniques .

It is recommended to complete each stage only after the previous one has been fully mastered.

Avoid scammers

Due to the high popularity of trading, there are many scammers operating in financial markets. These may be companies masquerading as reliable brokers. Or people offering universal and effective strategies.

To avoid scammers, you must follow these rules:

- work with a broker who has been on the market for more than a year;

- do not buy strategies that promise profit in 100% of cases;

- do not buy programs and indicators that automate trading;

- do not give your personal account to a third party;

- Do not trade using the Martingale method.

There are other tips too. You can avoid scammers if the trader thinks through every action, assessing all the risks.

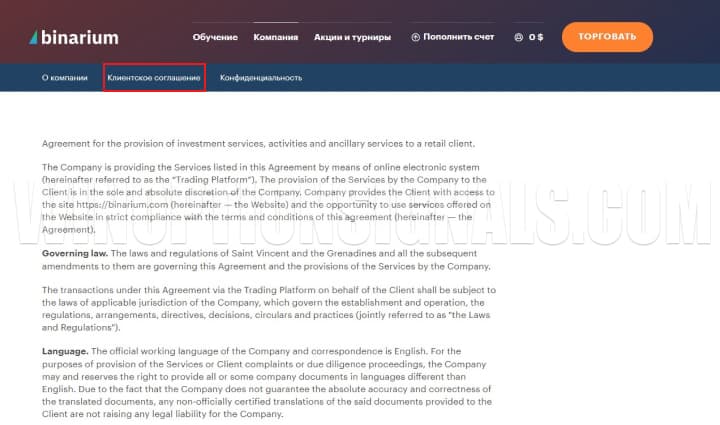

Open trades only after reading the terms of the agreement with the broker

A user agreement with a brokerage office often contains information that may limit trading conditions. This includes prohibitions on the use of two or more terminals, third-party software, trading robots, the Martingale system (not always) and more.

Violation of these conditions entails account blocking, as a result of which users cannot withdraw money.

Be sure to verify your account

Account verification is carried out to confirm the identity of the trader. This procedure is considered mandatory for clients of many binary options brokers. To verify accounts, they may request a passport (another document confirming identity), documents to confirm the residence address, and a photo of the bank card from which the balance is replenished.

To avoid problems in the future, experienced traders recommend immediately registering an account in your name.

See also:

The simplest methods of trading binary options

The Most Effective Trading Platforms for Binary Options

The broker does not withdraw money: how to withdraw money from the broker

To leave a comment, you must register or log in to your account.