Most well-known financial institutions often take certain assets as collateral when lending to people and companies. These are mainly real estate, cars and other property. But recently, the service of lending secured by cryptocurrencies has begun to gain popularity. One of the platforms offering such conditions is the company YouHodler, which is registered in Cyprus and appeared on the market in 2018, which makes it possible to earn money not only through loans, but also to receive passive income by depositing cryptocurrency at an impressive interest rate .

Clients of this platform can borrow real (fiat) money by providing a certain amount of cryptocurrency as collateral. YouHodler users can also receive a certain income by depositing their money.

Content:

- Advantages of YouHodler;

- How to apply for a loan in YouHodler;

- How to earn additional income using YouHodler;

- Withdrawal and replenishment of balance in YouHodler;

- How YouHodler protects clients' money;

- Conclusion.

Benefits of YouHodler

Despite the fact that the cryptocurrency-secured lending segment has appeared relatively recently, today there are many companies providing similar services. But YouHodler offers more favorable terms of cooperation than its direct competitors:

- clients can borrow an amount of up to 90% of the volume of coins that are left as collateral;

- deposit cryptocurrency (even in stablecoins) – up to 12% per year;

- support for several payment services (in addition to bank cards, transfers in stablecoins are available);

- 24/7 support;

- availability of accounts in major European banks, which proves the reliability of YouHodler.

The platform works only with trusted providers that provide fiat money transfers. The platform is constantly being improved, expanding the list of services. Moreover, work in this direction is always carried out taking into account the wishes of clients.

YouHodler clients have access to a multi-platform wallet (including its mobile version) with advanced technology for protecting personal information and funds. The platform supports two types of storing user money: “hot” and “cold”:

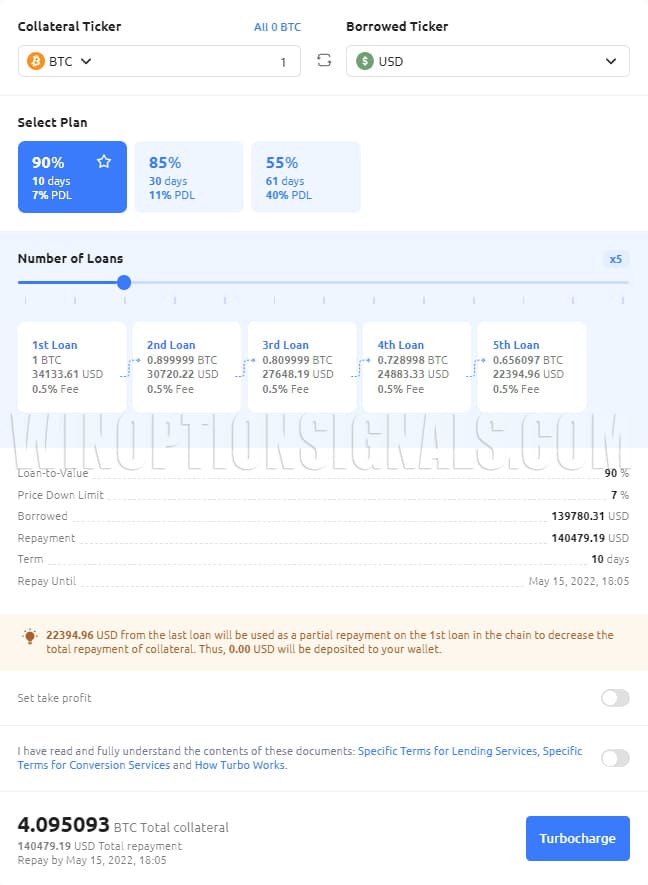

Among the features of YouHodler, clients include the Turbocharge function. With this option, users can take out multiple loans. In particular, having issued a loan in fiat money, clients use it to purchase cryptocurrency, which is then also used as collateral. By resorting to such a chain of loans, people can earn money from the growth of digital assets without attracting their own funds:

How to apply for a loan in YouHodler

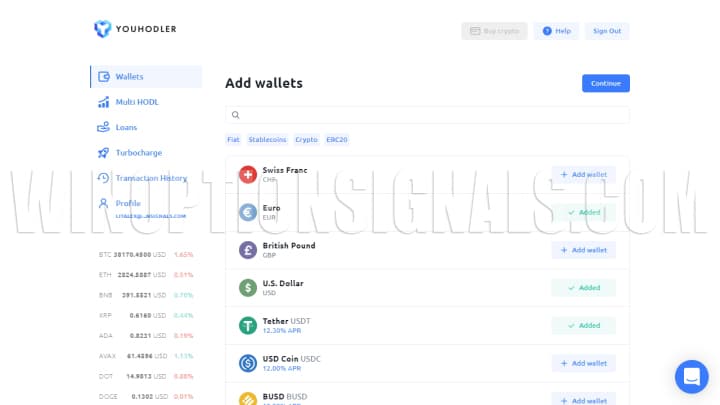

To apply for a loan, you must register on the site. Money is issued subject to the transfer of cryptocurrency to an internal account, which will be used as collateral. YouHodler supports the following digital assets:

- Bitcoin ;

- Bitcoin Cash;

- Bitcoin SV;

- Ethereum ;

- Ethereum Classic;

- Dash;

- Litecoin ;

- Ripple ;

- Monero and others.

The full list of supported cryptocoins can be found on the official website. After replenishing your internal account, you should apply for a loan. This process occurs automatically, so it takes a few seconds.

YouHodler differs from similar platforms in that it issues loans using its own money or client funds deposited.

Loans are issued in:

- dollars;

- rubles;

- Euro;

- USDT;

- bitcoins.

The money is transferred to the account specified by the client. Once issued, users must repay the debt within a specified period. However, the platform does not force clients to pay a certain amount each month. The payment amount can be any. The main thing is not to go beyond the established period.

After repaying the debt, clients can withdraw cryptocurrency or leave the latter in an internal account to receive loans in the future. If a person does not have free finances, then the loan can be repaid using collateral. To do this, you need to click on the “Close Loan Now” button, and the system will automatically transfer part (or all) of the cryptocurrency amount at the current rate, thus paying off the debt.

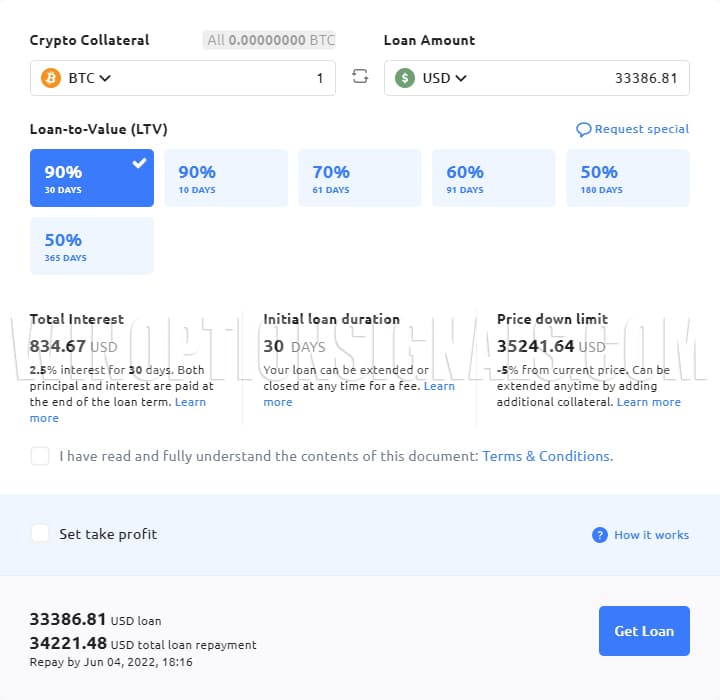

YouHodler allows you not only to change the volume of transfers, but also the size of the collateral and loan. So, if the client leaves as collateral:

- 90% of the cryptocurrency amount, you can get a loan for up to 30 days at a rate of 36% per annum;

- 70% – term 60 days and rate 30%;

- 50% – term 180 days and rate 15%.

The site also introduced restrictions on the minimum loan amount. Regardless of the conditions chosen, you can borrow a minimum of $100.

How to earn extra income using YouHodler

By transferring cryptocurrencies to a deposit in YouHodler, each user can receive a certain income, which is significantly higher than in any bank. This access option is subject to replenishment of the balance with the following assets:

- XPR;

- BTC;

- ETH;

- LINK;

- USDT;

- PAX;

- XLM;

- DAI and others.

Here is the deposit percentage (APY) for some of the coins:

The level of profitability is determined depending on the cryptocurrency. Deposits in stablecoins bring a larger amount (12% per annum), while a smaller amount (3%) comes from BNB and HT. When investing PAXG, the site accrues 8.2%, BTC – 4.8%, and other coins – 4.5%.

The platform also introduced restrictions on the minimum and maximum size of deposits to the internal account:

- BTC – from 0.1 to 1.5;

- ETH – from 1 to 100;

- BNB and HT – from 50 to 750;

- LINK – from 50 to 500;

- XRP – from 1,000 to 100,000;

- XLM – from 3,000 to 300,000;

- stablecoins - from 1,000 to 50,000;

- PAXG – from 0.1 to 15.

YouHodler immediately begins to accrue interest on the deposit after replenishing the internal account. However, the first money is transferred after a week of storage. Subsequently, interest is accrued at the same time. You can close your deposit and receive interest at any time; storing money on a deposit is much more profitable than in cold cryptocurrency wallets.

Withdrawal and replenishment of balance in YouHodler

To top up your balance in cryptocurrency, you can use the following wallets:

- SegWit;

- Bench32;

- ERC20 and Omni for USDT.

There are no commissions charged for such transactions (except for those charged within the network). The enrollment speed depends on the type of network selected. Basically, two confirmations are enough for this, but when transferring stablecoins - ten.

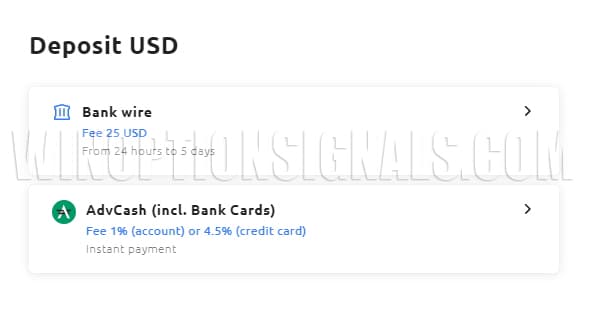

To top up your balance with fiat money, you can use a bank transfer or ADVCash:

When using bank transfer, a fee of 25 USD is charged. Payments made from aggregated accounts are not supported for these types of transactions.

When withdrawing funds from your balance, fees are charged only if the transfer is REP (0.2 coins), LINK (1) or BAT (10). When conducting such transactions in stablecoins, you are allowed to send at least 4 USDT. The commission in this case is 3 USDT.

When applying for a loan in fiat money and transferring the latter to a bank card, you will have to pay a fee of 5% of the withdrawn amount.

How YouHodler protects clients' money

After entering the market, YouHodler, judging by the reviews, had certain problems related to security. However, after some time, the developers eliminated all the “holes” in the protection. To increase the security of customer money, the company uses several methods:

- card transactions are carried out within the framework of PCI standards;

- all card data is immediately sent to the payment system and is not stored in internal databases;

- when conducting transactions with cryptocurrencies, the CCSS standard is used;

- when checking KYC, all information is sent directly to the provider, who performs this procedure;

- use of SSL encryption and all client passwords;

- funds are stored in “cold” and “hot” wallets;

- having an insurance fund of $1 million.

Additionally, the site offers each user to undergo two-factor verification. YouHodler regularly orders security checks from a third party, and for authentication uses OAuth 2.0, a protocol that eliminates the need for users to send a login and password to the application, and also differentiates rights.

In addition, YouHodler is a member of the Blockchain Association, which is an independent organization that resolves disputes between cryptocurrency platforms and investors.

Conclusion

Despite the fact that YouHodler is a young service and does not have many reviews, the site has managed to establish itself as a reliable resource with a user-friendly interface and round-the-clock support. High interest rates on deposits provide the opportunity for good passive income. The platform offers popular services for lending to people with collateral in the form of cryptocurrency.

See also:

To leave a comment, you must register or log in to your account.